Wage and hour laws employers should know

- Wage and hour laws dictate how much you need to pay an employee, and how many hours they can work

- As an employer, it’s critical to ensure your employee handbook policies follow wage orders and hour requirements

- Homebase HR Pro gives you live access to certified HR experts who can help you navigate the laws in your area

What is wage and hour compliance?

Wage and hour orders are labor law rules and regulations put in place by both federal and state departments of labor that require employers to pay employees a certain wage and dictate the hours worked that an employee must be paid for.

These state and federal laws are part of the list of employee rights, which include minimum wage rights, overtime pay laws, child labor laws, rest periods, and meal periods. These division of labor standards are laid out in the federal Fair Labor Standards Act (FLSA).

As an employer, it’s critical to ensure your employee handbook policies follow wage orders and hour requirements, or you could face serious fines and penalties from the government. Employees can also file a complaint against your business, which could result in a hefty lawsuit.

Wage and hour laws differ depending on where you live, and if you don’t have an HR professional working with you, it can be difficult to keep track—especially with the frequency of change that occurs in terms of minimum wage. Homebase HR Pro gives you live access to certified HR experts who can help you navigate the laws in your area. Once you are a member, you will also receive alerts for labor law updates so you can always ensure you are on top of changes without having to do the research yourself.

What is the federal wage and hour law?

Employees covered by the federal Fair Labor Standards Act must be paid minimum wage. Federal minimum wage laws dictate that the minimum wage is $7.25 an hour, however many states have their own minimum wage requirements that are higher than the federal minimum wage.

If you operate in a state or city with a higher minimum wage than the federal rate, you must pay the highest amount.

The federal government also has an overtime pay requirement, meaning employees must be paid additional wages outside of regular hours. According to the US Department of Labor, employers must pay nonexempt employees an overtime rate of at least one and a half times the regular rate of pay if they work in excess of 40 hours in one workweek.

There are several ways to determine if an employee is exempt or non-exempt, meaning whether or not they are entitled to overtime pay. If your employee earns less than $684 per week, or $35,568 per year, you must adhere to the FLSA rules and regulations and pay them overtime for hours worked in excess of 40 hours per week.

Here are a few other characteristics of non-exempt employees:

- They are directly supervised by a manager

- The employee is not employed in a “bona-fide executive, administrative, outside salesman, or professional capacity”

- They do not make their own management decisions and are expected to follow orders

An exempt employee is not covered under the FLSA, meaning you do not have to pay them overtime for extra hours worked in a week. There is an FLSA exempt test you can conduct to determine if your team member is not covered under the law.

For starters, they must be paid more than $684 per week in salary, or $35,568 per year in lieu of an hourly wage. Their work must also fall under these categories:

- Executive

- Administrative

- Professional

- Computer

- Outside sales

While the DOL does have laws around minimum wage, overtime, and recordkeeping, there are a few areas that are not covered by the US government. The FLSA does not require severance pay, paid sick leave, vacation and holiday time, or non-production cash bonuses. However, certain unpaid leave rights are covered under the Family and Medical Leave Act.

As mentioned before, HR Pro is a great tool for learning the important rules around federal wage and hour laws. Your dedicated expert will answer any questions you may have around minimum wage and overtime so you can make better decisions and easily remain compliant.

Barzotto

Marko Sotto

Owner at Barzotto

What are the wage and hour laws by state?

While the federal minimum wage is $7.25 per hour, many states have their own rates that you are responsible for paying employees. There are also additional wage and hour laws based on where you live. For example, Massachusetts’ blue laws dictate how much you must pay an employee for working on Sundays and certain holidays.

California wage and hour laws, which are enforced by the Division of Labor Standards Enforcement (DLSE) are also more robust than federal rules. For businesses with 25 or fewer employees, California’s minimum wage is $13 per hour, and $14 per hour for businesses with more than 25 workers.

California employment law also requires more rules around overtime pay. Employees must be paid overtime at rates of:

- Time and a half for all hours worked in excess of eight hours in any workday

- Double pay for any hours worked in excess of 12 hours a day

- Time and a half for the first eight hours worked on the seventh consecutive day of work in one week

- Double pay for any hours worked in excess of eight on the seventh consecutive day of work in one week

Many other states have their own specific labor code sections regarding minimum wage and overtime rules. You can check out your state labor law guide to learn more about what’s required in your area.

While HR Pro cannot provide official legal advice about how you pay your employees, our tool can help you better understand the laws and requirements you are subject to. HR Pro provides training and labor law alerts on wage and hour laws, workplace safety, employee rights, and more to ensure you are on top of the necessary labor legislation you must follow.

What are some exceptions to the federal minimum wage?

The federal minimum wage law applies to businesses with an annual gross volume of sales or of at least $500,000. Additionally, employers who are engaged in interstate commerce or in the production of commerce goods, including transportation, communications, or who use mail or phones for interstate commerce.

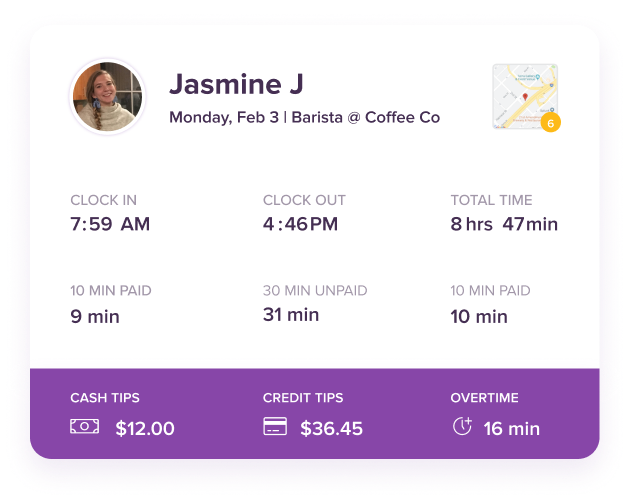

Employees who receive tips regularly typically can be paid a lesser minimum wage. On the federal level, the tipped minimum wage is $2.13 per hour. Many states have a higher tipped minimum wage, and some states req uire tipped employees to be paid the same minimum wage as other employees.

Workers under the age of 20 may be paid a minimum wage of $4.25 per hour for the first 90 days of employment, or until they reach 20 years of age. Then they must be paid the regular rate.