Tracking overtime for hourly workers can be one of the biggest headaches for small business owners managing payroll on their own. If you’re one of those business owners, you might be wondering: Is overtime taxed more?

It’s easy for the overtime hour count to get out of hand as you manage a busy team, especially without time tracking tools with overtime alerts to warn you before it’s time to do payroll.

How will overtime hours affect your payroll taxes?

Here’s the short answer: Overtime itself isn’t taxed more. But overtime earnings can push overtime workers into a new tax bracket.

Don’t worry — we’re going to answer your questions about overtime taxes and exemptions, so you feel empowered enough to run your own payroll without having to turn to a professional.

Let’s dive in to learn more about overtime pay, how to calculate taxes with overtime, and overtime tax exemptions.

Is overtime taxed more?

Overtime hours — which the Department of Labor considers any hours worked outside a full-time, 40-hour week — aren’t taxed more. When running hourly payroll, you’ll withhold the same taxes from an employee’s overtime wages that you would from their regular wages.

You don’t have to make two separate calculations when withholding federal, state, and FICA (Federal Insurance Contributions Act, i.e. Social Security and Medicare) taxes from your employee’s earnings.

An employee’s overtime earnings can push them into the next tax bracket, however, in which case the IRS and state tax a greater percentage of their gross income, which comprises their combined regular and overtime income.

How is overtime taxed?

If you’re running your first payroll for an employee who worked overtime, deduct taxes from the sum of their overtime and regular earnings. So, if they made $1,000 in regular earnings and $300 in overtime earnings, you’ll add those amounts together and come up with a sum of $1,300.

On payday, here’s what you’ll withhold from that $1,300:

Employee-paid taxes

- Federal income taxes, which are based on employee earnings and W-4 withholding allowances

- FICA taxes: 6.2% for Social Security and 1.45% for Medicare

Employer-paid taxes

- FUTA (Federal Unemployment Tax Act) taxes: An employer pays a 6.0% tax on the first $7,000 of employee earnings

- SUI (State Unemployment Insurance): An employer pays a tax based on a state-provided rate

You can rest easy knowing there’s no specific overtime tax. You’ll just withhold the required taxes from an employee’s total income for that pay period, which is regular plus overtime earnings.

Yes, more overtime work can mean withholding more taxes, but that’s because employees just get taxed at a higher rate when their overtime earnings move them to the next tax bracket.

What is considered working overtime?

Working overtime means working additional hours beyond the regular working schedule. It can vary from position to position and industry to industry.

In some jobs, like office jobs, the regular working schedule is usually 8 hours a day or 40 hours a week. If someone in an office job works more than these hours, like 9 or 10 hours a day, it is considered overtime.

Why is overtime taxed more?

Overtime may be taxed more than regular wages because of how the tax system works. When you earn money, like your regular wages, the government takes a portion of it as taxes. The amount of tax you pay is usually based on how much you earn.

Now, when you work overtime and earn extra money, it can push you into a higher tax bracket. Tax brackets are like different levels or categories based on income, and each bracket has its own tax rate.

The more money you make, the higher the tax rate can be.

Higher earnings = higher tax bracket

So, when you earn overtime pay, that additional income can put you into a higher tax bracket, and as a result, you might have to pay a higher percentage of taxes on that extra money.

This means that a larger portion of your overtime earnings goes toward taxes compared to your regular wages.

Overtime varies by industry

In other industries, the regular working schedule may be different. For example, industries like healthcare, manufacturing, or retail may have different working schedules. In healthcare, nurses and doctors often work in shifts, and if they work extra hours beyond their scheduled shift, it can be considered overtime.

In manufacturing or restaurants, where there might be different work patterns, overtime could be when employees work beyond their scheduled hours.

Overtime varies by position

Overtime can vary by position depending on the job requirements and industry norms. Hourly workers, like those in retail or restaurants, usually qualify for overtime pay when they work more than 40 hours a week.

Salaried employees may or may not be eligible for overtime pay, depending on their specific job and local regulations. Professional or managerial roles often don’t receive overtime pay, as additional hours may be considered part of their responsibilities.

Unionized positions often have negotiated agreements that outline overtime criteria and compensation.

Overtime tax brackets

Because the legal overtime rate of pay is 1.5 times an employee’s regular hourly rate, staying on top of your small business labor costs means keeping an eye on costly overtime hours. It can also complicate employee taxes if their overtime hours push them into a higher tax bracket.

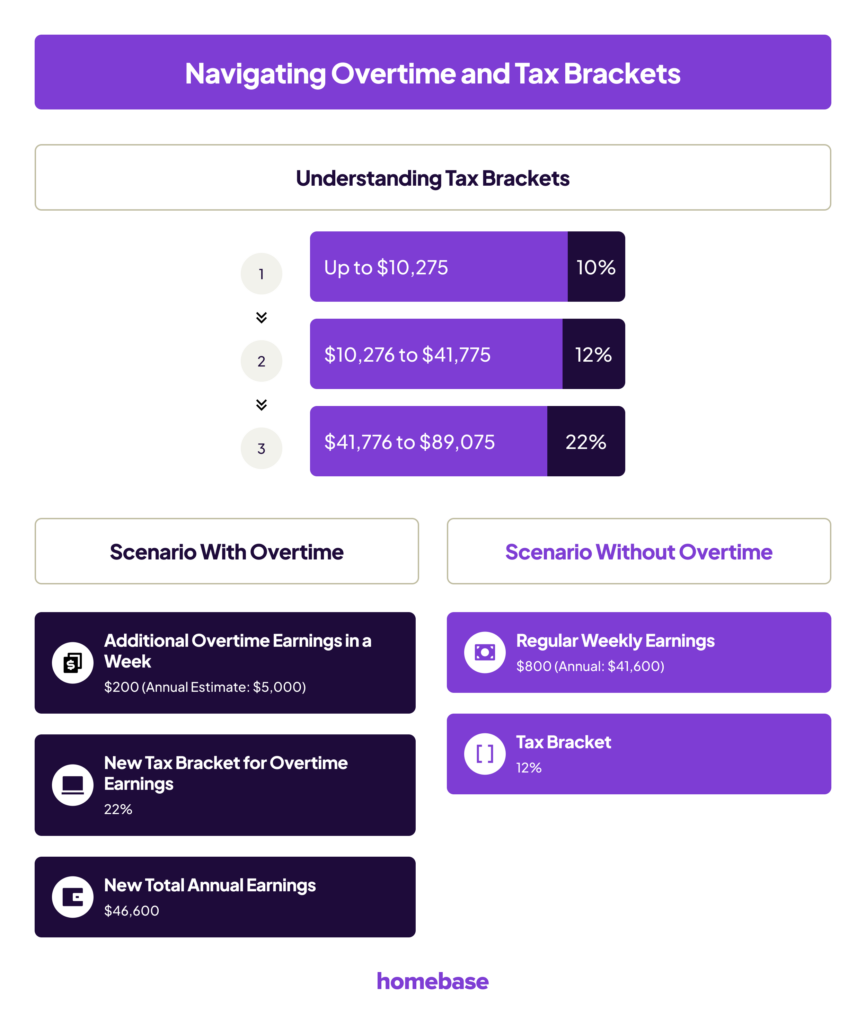

Let’s look at a few 2024 annual income tax brackets for single filers to see why that matters:

Here’s where it gets tricky: If an employee makes $800 per week in 2024, you have to withhold taxes based on the second tax bracket on this chart.

But if they work overtime hours during a week in July and make $1,000, that pushes them to the third bracket. That means you’ll have to withhold more federal income taxes from their paycheck that week than you normally would.

How is overtime tax calculated?

While there’s no specific ‘overtime tax,’ you’ll need to calculate taxes for overtime just like you would for regular taxes.

Calculate your employee’s overtime tax

When running payroll, tax your employee’s overtime wages together with their regular wages. Let’s take a look at how you’d calculate the FITW (Federal Income Tax Withholdings) for an example employee, Joaquin, who we’ll pretend you pay weekly.

- Figure out your employee’s total taxable income. Joaquin makes $18 per hour and works 40 hours a week, so he made $720 in regular wages.

But Joaquin also worked 7 extra hours of overtime this week. So, according to the Fair Labor Standards Act, you have to pay him time-and-a-half, or 1.5 times his hourly wage for each overtime hour. Joaquin’s overtime rate is $27 an hour, and he made $189 in overtime wages.

Add the regular pay and overtime pay together to figure out what Joaquin’s taxable income is:

$720 (regular earnings) + $189 (overtime earnings) = $909 (total taxable income) - Determine your employee’s filing status. Use Joaquin’s Form W-4 to determine whether he has any dependents. His filing status is marked as ‘single,’ and he hasn’t indicated any other withholdings. That means he’ll have the maximum FITW taken from his paycheck compared to other employees who file jointly and/or have dependents.

- Use the Wage Bracket Method tables in the IRS’s Publication 15-T to calculate your employee’s income tax withholdings. Go to page 11 for the ‘Wage Bracket Method Tables for Manual Payroll Systems with Forms W-4 from 2020 or Later.’ Use the worksheet, or simply scroll down to the Weekly Payroll Period tables until you find Joaquin’s wage bracket for that week. Because he made $909 that week, and because he has standard withholding status as a single filer, you’ll withhold a standard deduction of $75 in income taxes for Joaquin.

It’s possible to do payroll taxes manually, but it takes time to calculate income tax withholdings for every employee. That’s why we recommend using an automated payroll provider software like Homebase to avoid tax liability, keep you compliant with labor laws and make this process faster, easier, and error-free.

Are there any exemptions to the overtime tax laws?

Knowing if your employees are exempt from overtime tax laws means figuring out whether they’re exempt from overtime pay. According to the FLSA (Fair Labor Standards Act), employees are exempt from overtime pay if they meet these requirements:

- You pay them on a salary basis: You pay an employee an annual salary rather than an hourly rate.

- You pay them the federal minimum weekly requirement. As of January 2020, employees aren’t entitled to overtime pay if their employer pays them a weekly minimum salary of $684 a week.

- Employee responsibilities pass the duties test for exempt white-collar workers. Employers don’t have to pay overtime if their employees’ job description passes the duties test for executive, administrative, and professional employees. For example, the FLSA outlines the primary duty of professional workers as one that involves “invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor.”

Visit Homebase’s state labor laws hub to learn more about your state’s requirements for employees who are exempt and non-exempt from overtime pay.

Is working overtime worth it for employees?

Whether working overtime is worth it for employees depends on various factors and individual circumstances. Let’s discuss the pros and cons, including the tax implications.

Pros of working overtime:

- Extra income: Overtime can provide additional money that can be used for savings, paying off debts, or achieving financial goals.

- Overtime pay: Some employers offer higher pay rates for overtime hours, making the extra effort financially rewarding.

- Skill development: Working overtime may offer opportunities to gain new skills, handle challenging tasks, or take on more responsibilities, enhancing career growth.

Cons of working overtime:

- Time and work-life balance: Working extra hours can reduce personal time, affecting family, relaxation, and hobbies, potentially leading to burnout or strained relationships.

- Fatigue and productivity: Extended work hours can result in exhaustion, reduced productivity, and decreased job satisfaction.

- Health impact: Working excessive hours over a long period may negatively affect physical and mental well-being.

How much overtime an employee can make

Now, let’s calculate how much more an employee might take home using the given tax brackets:

Assuming an employee’s regular salary puts them in the second tax bracket, where the tax rate is 12%, and they work overtime and earn an additional $5,000.

Calculation:

Regular taxable income: $41,775 (tax rate: 12%)

Tax on regular income: $1,027.50 + 12% of ($41,775 – $10,275) = $1,027.50 + 12% of $31,500 = $1,027.50 + $3,780 = $4,807.50

Overtime income: $5,000 (tax rate: 22%)

Tax on overtime income: $4,807.50 + 22% of ($5,000 – $41,775) = $4,807.50 + 22% of $0 (as the overtime income doesn’t exceed the upper limit of the tax bracket) = $4,807.50

Total tax paid: $4,807.50

To calculate how much more the employee takes home, subtract the total tax paid from the overtime income:

Overtime income – Total tax paid = $5,000 – $4,807.50 = $192.50

In this case, the employee takes home an additional $192.50 from working overtime after accounting for taxes.

This simplified calculation demonstrates that the tax paid on overtime income is less than the overtime earnings. However, keep in mind that actual tax calculations can be more complex, including deductions, exemptions, and other factors.

When deciding whether working overtime is worth it, employees should consider their financial goals, work-life balance, personal circumstances, and consult with tax professionals or use reliable tax calculators for accurate assessments.

Busting the overtime tax myth

While it’s true that working overtime can have tax implications, it doesn’t mean that it’s always a bad idea. In fact, working overtime can still increase your take-home cash. Here’s why:

Shifting tax brackets

One misconception is that earning more through overtime pushes you into a higher tax bracket, resulting in all your income being taxed at a higher rate. However, tax brackets are marginal, which means only the income within each bracket is taxed at that specific rate.

So, even if you move into a higher tax bracket, only the portion of income within that bracket is subject to the higher tax rate.

For example, if you earn $40,000 in a year and fall into a 12% tax bracket, and then work overtime to earn an additional $5,000, pushing you into a 22% tax bracket, only the $1,225 (the excess over $41,775) would be taxed at the higher rate. The rest of your income is still taxed at the lower rate.

Overtime pay rate

Many employers offer a higher pay rate for overtime hours. This means that you not only earn more money but also get paid at a higher hourly rate for each additional hour worked. So, even after accounting for taxes, you may still end up with more take-home cash compared to your regular pay.

For instance, if your regular hourly rate is $15 and your overtime rate is $22.50 (1.5 times your regular rate), working overtime can provide a significant boost to your paycheck.

Overtime as a short-term solution

Sometimes, working overtime can be a temporary solution to meet specific financial goals or address unexpected expenses. While the additional income may be taxed at a slightly higher rate, it can still help you achieve your goals faster or manage unexpected financial situations.

Remember, everyone’s tax situation is different, and it’s important to consider your specific circumstances.

It’s wise to consult with tax professionals or use reliable tax calculators to estimate the impact of overtime on your net income accurately.

Assessing Overtime Impact on Taxation and Personal Well-being

How Homebase can automate your payroll taxes

As a small business owner manually tracking time and running your own payroll, it’s not just taxes that worry you about overtime — it’s payroll compliance as well. You want to make sure you’re doing everything you can to follow your local labor guidelines for overtime.

Homebase’s free time clock tool takes that off your plate with automatic clock-outs and alerts notifying you when employees are getting close to overtime.

You can also use it to set up break and overtime rules that will keep you compliant with federal, state, and local labor laws, as well as FLSA rules.

Last but not least, Homebase’s HR tools and payroll features include an extensive library of resources, guides, templates, and automations to help you get started so that you don’t have to become your own HR expert when payday comes around.

Overtime tax FAQs

Why is overtime taxed?

Overtime is taxed because the IRS still considers it part of an employee’s income. Although no special overtime tax exists, you still have to withhold federal income and FICA taxes from an employee’s overtime wages.

Does overtime get taxed differently than regular time?

Overtime doesn’t get taxed any differently than regular wages. Overtime wages can, however, increase an employee’s gross pay enough that they’ll move into a higher tax bracket. For example, if an employee who usually earns $800 per week works enough overtime to earn $1,000 in one week, you’ll have to withhold more federal income taxes than you usually do during that week.

What are the tax brackets for 2022?

Below are the annual federal income tax brackets for 2022 according to the IRS’s Publication 15 – T. Keep in mind that these tax brackets are for standard withholding and not for employees who have checked the box in Step 2 of Form W – 4:

| Married Filing Jointly | ||||

| At least— | But less than— | The tentative amount to withhold is— | Plus this percentage— | Of the amount that the Adjusted Annual Wage or Payment exceeds— |

| $0 | $13,000 $0.00 | $0.00 | 0% | $0 |

| $13,000 | $33,550 | $0.00 | 10% | $13,000 |

| $33,550 | $96,550 | $2,055.00 | 12% | $33,550 |

| $96,550 | $191,150 | $9,615.00 | 22% | $96,550 |

| $191,150 | $$353,100 | $30,427.00 | 24% | $191,150 |

| $353,100 | $444,900 | $69,295.00 | 32% | $353,100 |

| $444,900 | $660,850 | $98,671.00 | 35% | $444,900 |

| $660,850 | … | $174,253.50 | 37% | $660,850 |

| Single or Married Filing Separately | ||||

| At least— | But less than— | The tentative amount to withhold is— | Plus this percentage— | Of the amount that the Adjusted Annual Wage or Payment exceeds— |

| $0 | $4,350 | $0.00 | 0% | $0 |

| $4,350 | $14,625 | $0.00 | 10% | $4,350 |

| $14,625 | $46,125 | $1,027.50 | 12% | $14,625 |

| $46,125 | $93,425 | $4,807.50 | 22% | $46,125 |

| $93,425 | $174,400 | $15,213.50 | 24% | $93,425 |

| $174,400 | $220,300 | $34,647.50 | 32% | $174,400 |

| $220,300 | $544,250 | $49,335.50 | 35% | $220,300 |

| $544,250 | … | $162,718.00 | 37% | $544,250 |

| Head of Household | ||||

| At least— | But less than— | The tentative amount to withhold is— | Plus this percentage— | Of the amount that the Adjusted Annual Wage or Payment exceeds— |

| $0 | $10,800 | $0.00 | 0% | $0 |

| $10,800 | $25,450 | $0.00 | 10% | $10,800 |

| $25,450 | $66,700 | $1,465.00 | 12% | $25,450 |

| $66,700 | $99,850 | $6,415.00 | 22% | $66,700 |

| $99,850 | $180,850 | $13,708.00 | 24% | $99,850 |

| $180,850 | $226,750 | $33,148.00 | 32% | $180,850 |

| $226,750 | $550,700 | $47,836.00 | 35% | $226,750 |

| $550,700 | … | $161,218.50 | 37% | $550,700 |