In our latest monthly installment of Main Street perspectives, we once again revisited the 60,000 businesses and one million active hourly employees that use Homebase to garner insight into the state of economic recovery in the US.

Here’s what we found.

How did Main Street fare in August?

The stagnation of July continued into August, as Main Street faces sustained suppressed consumer demand due to continued public health concerns and capacity / opening restrictions.

Since last month’s report, Congress has yet to agree on a stimulus plan, leaving Main Street on its own to find ways to survive in an increasingly unpredictable time period.

Furthermore, there is a concern that Main Street may face seasonal headwinds as the traditional end-of-summer slowdown begins to kick in, further exacerbating the already stagnant recovery observed this past month.

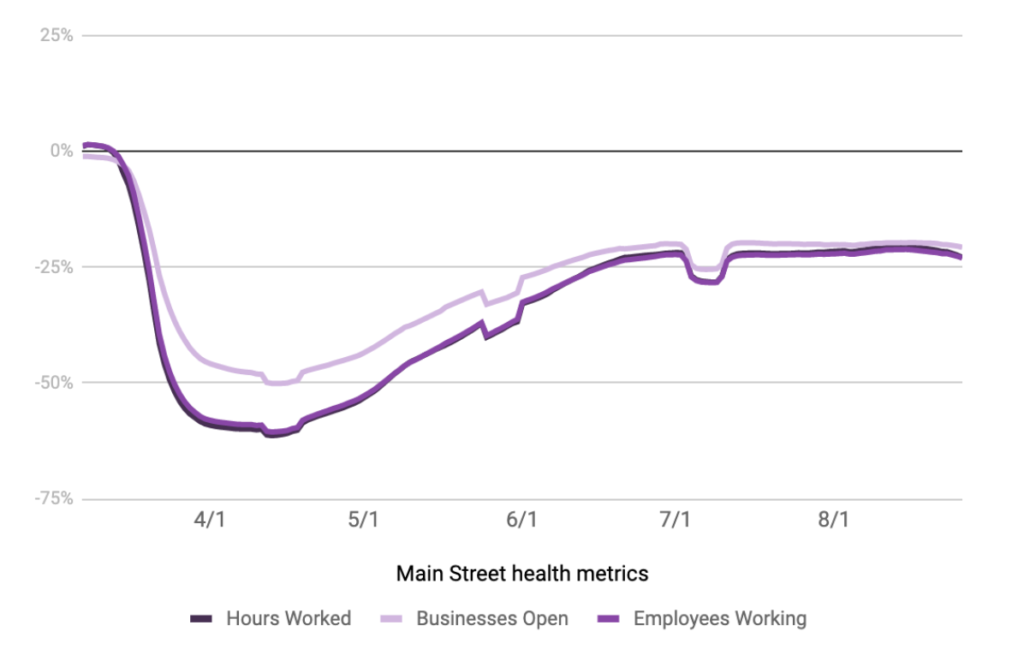

Small business economic recovery continues to be stagnant

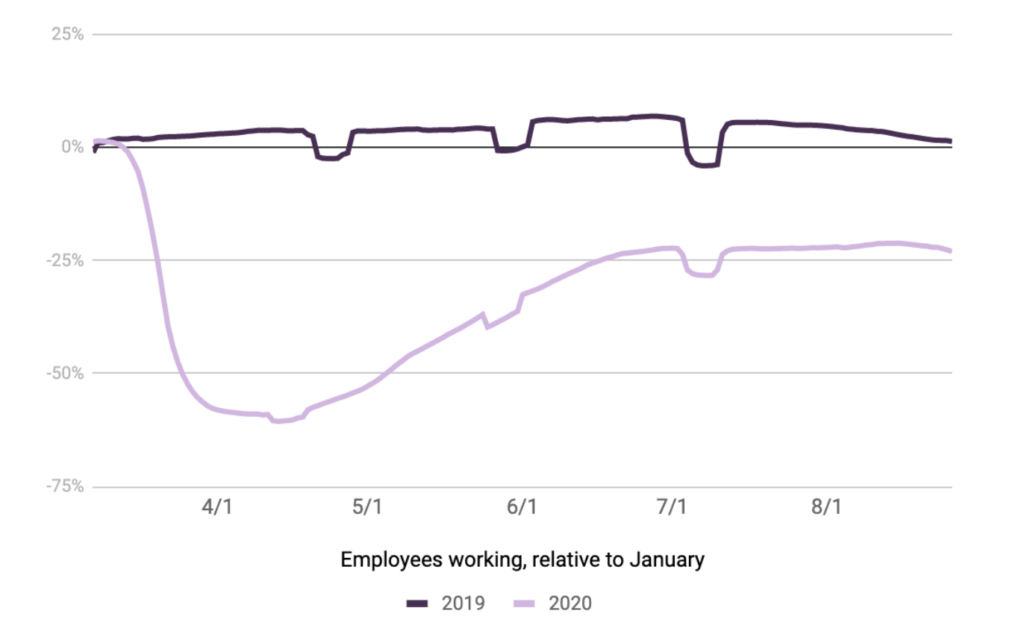

More than 20% of small businesses remain closed nationwide, resulting in little to no improvement in economic indicators compared to July.

The tail end of August shows slight slowing, potentially indicating that typical end-of-summer / back-to-school slowdowns may be beginning to set in.

While some areas of the country are still demonstrating improvement in employment and businesses open, declines in other regions have led to a net decline in overall economic activity.

Little to no improvement since end of June

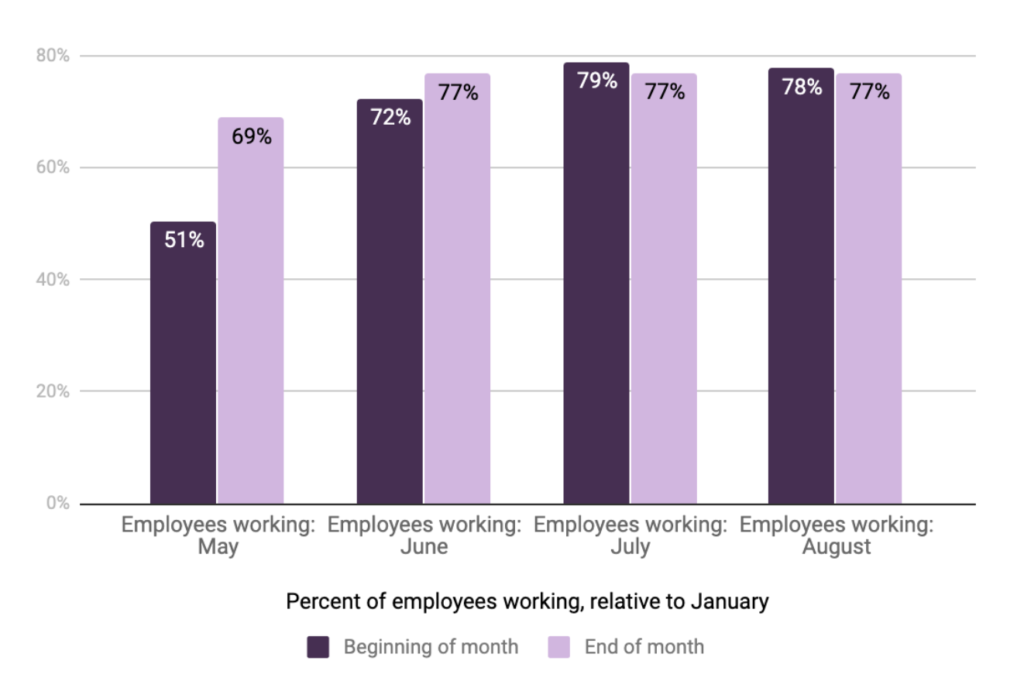

Similar to what we saw in July, fewer employees were working at the end of the month, relative to the beginning of the month.

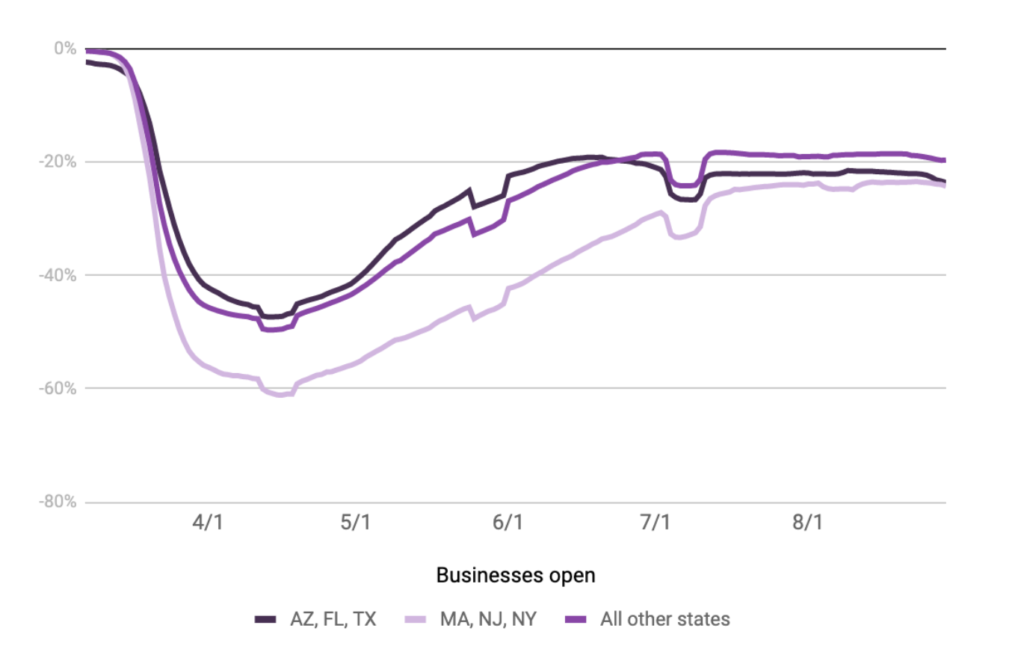

This month, we also affirmed what we observed in July in relation to discrepancies between “early open” vs. “late open” states: “late open” states (NY, NJ) have fully caught up to “early open” states (TX, FL) as “early open” states experienced contraction in July and August.

It’s worth noting that despite geographic differences, the state-level differences in economic impact are relatively minor compared to earlier on in the pandemic, especially considering how far below pre-covid levels every state (and the country as a whole) remains.

Implications for unemployment

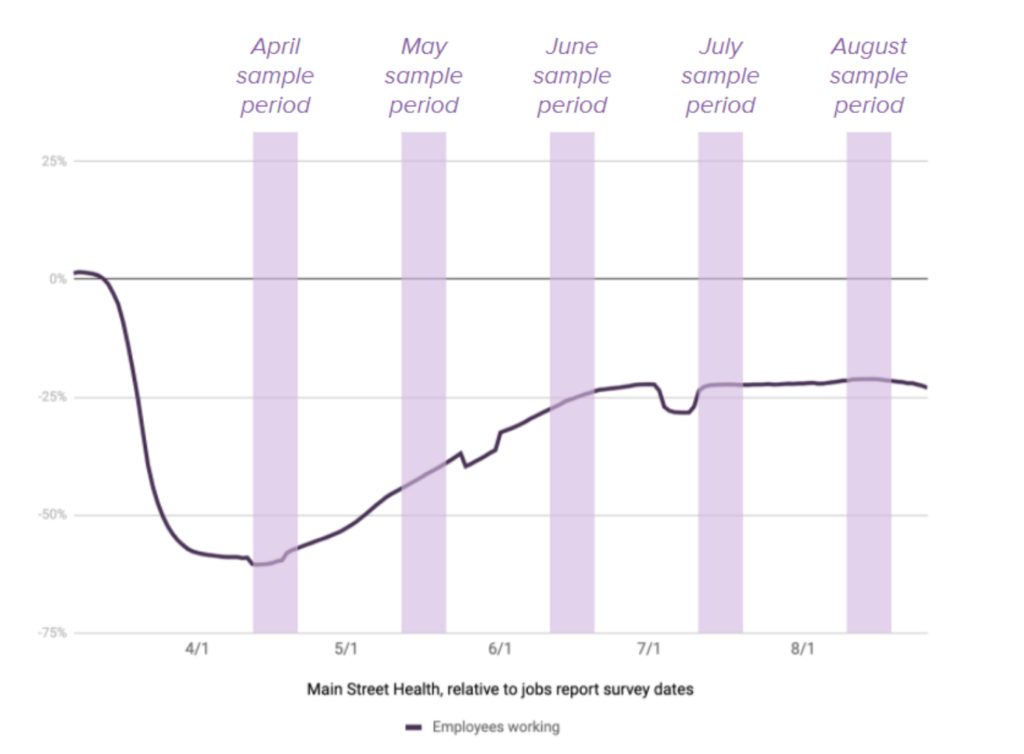

In our data, the August reference period saw a 2 percentage point improvement when compared against the July reference period. Therefore, the Bureau of Labor Statistics may report a slight improvement in economic activity, even though the general trend has been largely flat.

Regardless, it is clear that the improvement from July to August is less than improvement observed from June to July.

Below are the percentage of employees working (during the sample period) compared to our January baseline:

- August: -21%

- July: -23%

- June: -27%

- May: -42%

- April: -60%

Seasonal headwinds may be kicking in

In a typical year, economic activity slows down at the end of summer as students head back to school and cooler weather curbs outdoor spending. This may help to explain the slight dip at the end of August.

If this seasonal pattern is repeated this year, we could see exacerbated conditions stemming from further loss in employment heading into the fall without further government assistance to Main Street and its workers.

How has Homebase data been validated?

We’ve partnered with a number of academics and researchers to validate and improve the Homebase data. Here are a few examples:

- The St. Louis Federal Reserve suggested that Homebase data could be predictive of the jobs reports

- Researchers at Drexel used Homebase data to estimate the “true” employment level

- A team at UChicago and Berkeley used Homebase data to show disparate impacts across different groups

Questions or comments about our findings?

Contact Homebase VP of Data & Analytics Ray Sandza and Manager, Data Products Kevin Liang to learn more.

Homebase makes work easier for 100,000+ small (but mighty) businesses with everything they need to manage an hourly team: employee scheduling, time clocks, team communication, hiring, onboarding, and compliance. We are not Human Capital Management. We are not HR Software. We’re tools built for the busiest businesses, so owners and employees can spend less time on paperwork and more time on what matters.