From wrangling shift schedules and managing overtime to keeping an eye on labor costs, running a small business comes with its fair share of challenges. And just when you think you’ve got it all figured out, there’s the added complexity of differing overtime laws by state. That’s enough to make anyone’s head spin, so we’re simplifying it for you.

Use this easy guide for handling overtime with ease with a breakdown of federal and state laws, overtime exemptions, and step-by-step calculations.

What is overtime?

Overtime is the term used to describe any extra hours that an employee works beyond their standard workweek. Unless exempt, employees covered by the Fair Labor Standards Act (FLSA) must receive additional pay for any hours worked beyond 40 in a workweek. This extra pay is known as “overtime” pay.

Small businesses might ask employees to work overtime to help with labor-intensive tasks like inventory or during busy seasons like the holidays. Offering overtime pay not only makes the idea of extra work a bit more appealing but also provides a tangible reward for their efforts.

What are federal overtime laws?

In the U.S., the Fair Labor Standards Act (FLSA) oversees federal overtime laws. It’s there to protect workers, outline rules for overtime pay and eligibility, and make sure those working over 40 hours a week get fair compensation.

While the FLSA’s regulations are extensive, the basic overtime guidelines include:

Standard overtime pay: Beyond the regular 40-hour workweek, eligible employees are entitled to at least 1.5 times their standard pay rate for additional hours worked.

Minimum earnings: Anyone earning less than $684 per week or $35,658 annually automatically qualifies for overtime pay, regardless of other exemptions.

Record keeping requirements: Employers are required to maintain accurate records of hours worked, wages paid, and other relevant information to comply with overtime laws.

Who is exempt from overtime pay?

Despite these overtime laws, many Americans aren’t eligible to receive overtime pay based on their job duties, salary level, and the nature of their employment. Here’s an overview of who’s generally exempt from overtime pay:

White-collar exemptions

- Executive exemption: If you manage a business or department and regularly direct at least two full-time employees.

- Administrative exemption: If your work involves office or non-manual tasks related to business operations.

- Professional exemption: If you’re a learned professional or creative worker doing inventive or imaginative work.

Full-time salaried exemptions

As unfair as it may sound, full-time salaried employees are usually expected to do their job regardless of how many hours it takes. That’s because, unlike hourly employees, their pay is determined by their job duties rather than the hours they put in. But as you’ll see, there are a few exceptions to this rule.

Non-Exempt Employees

- Most hourly employees are entitled to overtime pay at 1.5 times their regular hourly rate for hours beyond 40 in a week.

- Certain salaried employees who don’t meet exempt status criteria are eligible for overtime pay. This includes those not meeting the minimum salary threshold of $35,658 annually.

Remember, overtime eligibility depends on the tasks employees do and how they’re paid, not just their job title. Labor laws vary by state, and employees can choose the rules (federal or state) that benefit them the most. To ensure you’re following overtime rules correctly, keep track of your team’s responsibilities and stay informed about federal and state labor regulations.

Overtime pay for hourly versus salaried employees

The way you calculate and structure overtime pay is different for hourly and non-exempt salaried employees. Here’s a brief overview of how overtime pay works for each.

Hourly employee

Hourly employees usually get 1.5 times their regular hourly rate when they work over 40 hours in a week. So if someone typically made $15 an hour, they would make $22.50 for each hour beyond the standard 40 hours.

Salaried Non-Exempt Employees

Salaried employees receive a fixed salary for regular hours, but non-exempt salaried workers also get overtime pay for working over 40 hours a week. Since they aren’t paid hourly, you’ll have to do a bit more math to figure out their overtime rate, so let’s look at an example.

Let’s say an employee has a weekly salary of $800 and is expected to work 40 hours. The regular hourly rate is calculated by dividing the weekly salary by the expected hours:

Regular Hourly Rate = Weekly Salary / Expected Hours

= $800 / 40

= $20 per hour

Then to find the overtime rate, you calculate one and a half times this regular hourly rate:

Overtime Rate = 1.5 * Regular Hourly Rate

= 1.5 * $20

= $30 per hour

So, if the employee works 45 hours in a week, they would receive their regular salary for the first 40 hours and then an additional $30 per hour for the 5 hours of overtime worked.

Keep in mind that most salaried employees aren’t eligible to receive overtime pay since they’re compensated for their job as a whole, rather than hourly.

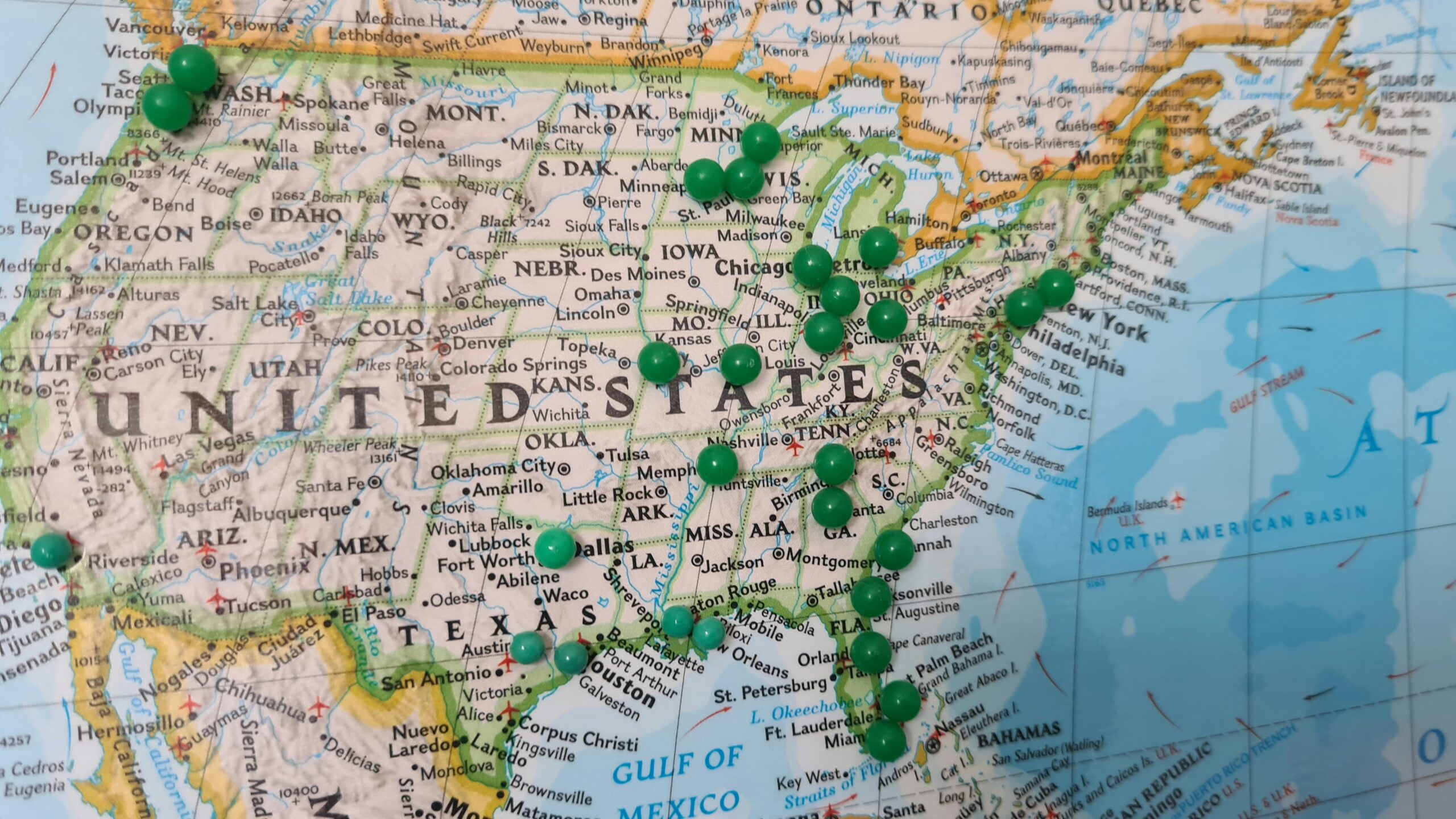

Overtime laws by state

Navigating overtime regulations can be tricky, and varying state labor laws make that even more so. To ensure your business is on the right page, here’s a breakdown of overtime laws by state.

Alabama overtime laws

Alabama follows federal guidelines.

Alaska overtime laws

In Alaska, overtime pay applies to non-exempt employees who work over 8 hours in a day or exceed 40 hours in a week. But, this doesn’t apply to employers with fewer than four employees and certain industries (like agriculture).

Arizona overtime laws

Arizona follows federal overtime rules.

Arkansas overtime laws

Arkansas follows federal overtime rules.

California overtime laws

In California, employers are required to pay overtime to non-exempt employees for hours worked beyond:

- 8 hours in a workday

- 40 hours in a workweek

- 6 days in a workweek

California also has a double-time law, so employees get double their hourly rate for working more than 8 hours on the seventh day in a row and/or beyond 12 hours in a day.

Colorado overtime laws

In Colorado, employers provide overtime pay to non-exempt employees for working beyond 12 hours in a day or 40 hours in a workweek.

Connecticut overtime laws

Connecticut follows federal overtime guidelines.

Delaware overtime laws

Delaware follows federal overtime rules.

Florida overtime laws

Florida follows federal overtime regulations.

Georgia overtime laws

Georgia follows FLSA guidelines.

Hawaii overtime laws

Hawaii follows federal overtime laws with some exceptions.

Idaho overtime laws

Idaho follows FLSA guidelines.

Illinois overtime laws

Illinois follows FLSA rules.

Indiana overtime laws

Indiana’s overtime rules align with FLSA guidelines.

Iowa overtime laws

Iowa follows federal overtime rules.

Kansas overtime laws

In Kansas, employers must pay overtime for hours worked beyond 46 in a workweek. But, if your business is covered by the federal Fair Labor Standards Act (which mandates overtime for hours beyond 40), follow those guidelines.

Kentucky overtime laws

Kentucky follows FLSA overtime guidelines.

Louisiana overtime laws

Louisiana follows FLSA overtime rules.

Maine overtime laws

Maine follows federal guidelines for overtime, but employees must earn more than $41,401 annually (rather than the federal threshold of $35,568) to be exempt.

Maryland overtime laws

Maryland follows state guidelines, but certain occupations have their own overtime rules. For instance, some farm workers are eligible for overtime pay when working beyond 60 hours in a week.

Massachusetts overtime laws

Massachusetts follows federal overtime laws with one exception. If businesses pay employees 1.5 times their regular pay for working on a Sunday or certain holidays, those hours don’t count towards the calculation of overtime.

Michigan overtime laws

Michigan overtime laws mirror FLSA guidelines, but they only apply to businesses with two or more employees.

Minnesota overtime laws

In Minnesota, state overtime laws kick in for hours worked beyond 48 in a workweek. But if your business is covered by the federal FLSA, it’s better to stick to the federal overtime rules (40 hours).

Mississippi overtime laws

Mississippi follows federal overtime laws.

Missouri overtime laws

Missouri follows federal overtime guidelines.

Montana overtime laws

Montana follows FLSA overtime laws.

Nebraska overtime laws

Nebraska follows federal overtime guidelines.

Nevada overtime laws

Nevada employers must pay overtime if employees work over 40 hours in a week or 8 hours in a day. However, this only applies if the employee earns less than 1.5 times the minimum wage per hour and is not valid if the employee agreed to work multiple 10-hour shifts in a week.

New Hampshire overtime laws

The state of New Hampshire follows the FLSA guidelines.

New Jersey overtime laws

The overtime laws in New Jersey align with FLSA guidelines.

New Mexico overtime laws

The state of New Mexico follows FLSA guidelines.

New York overtime laws

In line with FLSA guidelines, New Yorkers are entitled to overtime pay for working beyond 40 hours a week. But New York’s rules extend beyond federal exemptions, so most employees are eligible for overtime pay (with some exceptions).

North Carolina overtime laws

The North Carolina Wage and Hour Act aligns with FLSA guidelines.

North Dakota overtime laws

North Dakota upholds federal overtime law.

Ohio overtime laws

Ohio adheres to FLSA guidelines.

Oklahoma overtime laws

Oklahoma defers to federal overtime laws.

Oregon overtime laws

While Oregon’s state overtime laws align with federal laws, specific sectors like government agencies have their own overtime rules.

Pennsylvania overtime laws

Pennsylvania’s overtime law conforms with federal overtime guidelines.

Rhode Island overtime laws

Rhode Island upholds the FLSA overtime payment guidelines.

South Carolina overtime laws

Similar to North Carolina, South Carolina follows federal overtime laws.

South Dakota overtime laws

South Dakota complies with federal overtime law.

Tennessee overtime laws

Tennessee follows the federal overtime laws outlined in the FLSA. abides by federal overtime laws.

Texas overtime laws

Texas’s overtime law mirrors FLSA guidelines.

Utah overtime laws

Utah follows FLSA guidelines.

Vermont overtime laws

Vermont’s overtime laws closely mirror FLSA guidelines, but only apply to employers with two or more employees.

Virginia overtime laws

Despite passing the Virginia Overtime Wage Act in 2021, it was rolled back less than a year later to realign with federal FLSA guidelines.

Washington overtime laws

Washington’s overtime laws align with federal rules with a few exceptions. Employers in Washington can’t require registered or licensed practical nurses to work overtime and double-time pay may be required for certain public works projects.

West Virginia overtime laws

Most West Virginia companies follow federal rules, but they can qualify for supplementary state overtime benefits if they meet three criteria:

- They don’t qualify for federal enterprise coverage.

- Most of their employees wouldn’t qualify for overtime under federal law.

- They have at least six employees.

If all three criteria are met, employees can receive 1.5 times their usual pay for overtime. For those working two jobs, overtime is calculated using the higher-paying job. For example, if someone works at a restaurant for $12/hr and a shop for $15/hr, their overtime pay rate would be $15/hr.

Wisconsin overtime laws

Wisconsin adheres to federal overtime laws.

Wyoming overtime laws

Wyoming enforces federal overtime laws.

Manage overtime with ease

If you’ve made it this far, you might be feeling a bit overwhelmed, which is completely valid. Navigating labor laws and handling overtime for your team is no small feat. Even a minor slip-up could have significant consequences, so attempting to manage it on your own (especially manually) isn’t worth the risk.

Enter Homebase–your ally in simplifying the complexities of labor compliance. Through real-time reporting and automated time tracking, Homebase delivers up-to-the-minute insights into employee hours, overtime, and labor costs. You can even set up specific break and overtime rules, create alerts to notify you when members of your team are reaching their overtime threshold, and store time cards in Homebase to comply with FLSA record-keeping rules.

Still worried about those pesky overtime calculations? Homebase has you covered. With seamless payroll integrations, you can automatically add overtime pay to your team’s paychecks—no calculations required.

At Homebase, we know small business owners have enough on their plate without keeping up with evolving labor regulations, so we’ll automatically send you labor law compliance notices to alert you of any upcoming changes. And, for added peace of mind, we have certified HR Pros on hand to review your payroll and overtime policies.

Don’t ruin another night’s sleep worrying about overtime logistics. Stay on top of it with Homebase scheduling and timesheets. Try for free.

Overtime laws by state FAQs

Which states have daily overtime laws?

There are only a handful of states with daily overtime laws. If you work more than 8 hours a day in Alaska, California, and Nevada or more than 12 hours a day in Colorado, you’re eligible for daily overtime. In Oregon, this also applies to anyone working over 10 hours a day in the manufacturing industry.

What is a non-exempt salaried employee?

A non-exempt salaried employee is an employee who is legally entitled to receive overtime pay despite earning a salary (rather than hourly pay). Although the reasons for this vary, it’s typically because their job duties don’t meet the criteria for exempt status.

Is not paying your employees for overtime work illegal?

Yes, it is illegal to not pay eligible employees for overtime work under the Fair Labor Standards Act (FLSA). Businesses can face legal consequences like back pay, fines, and other penalties for not complying with federal (and state) overtime pay laws.

How much do employers need to pay for overtime pay?

Generally, non-exempt employees should get 1.5 times their regular hourly rate for working beyond 40 hours in a week. But, this can vary by state, so make sure to check local labor rules.