January 2026 REPORT

Main Street Workforce Stabilizes at 2025 Levels After Holiday Adjustment

Key findings:

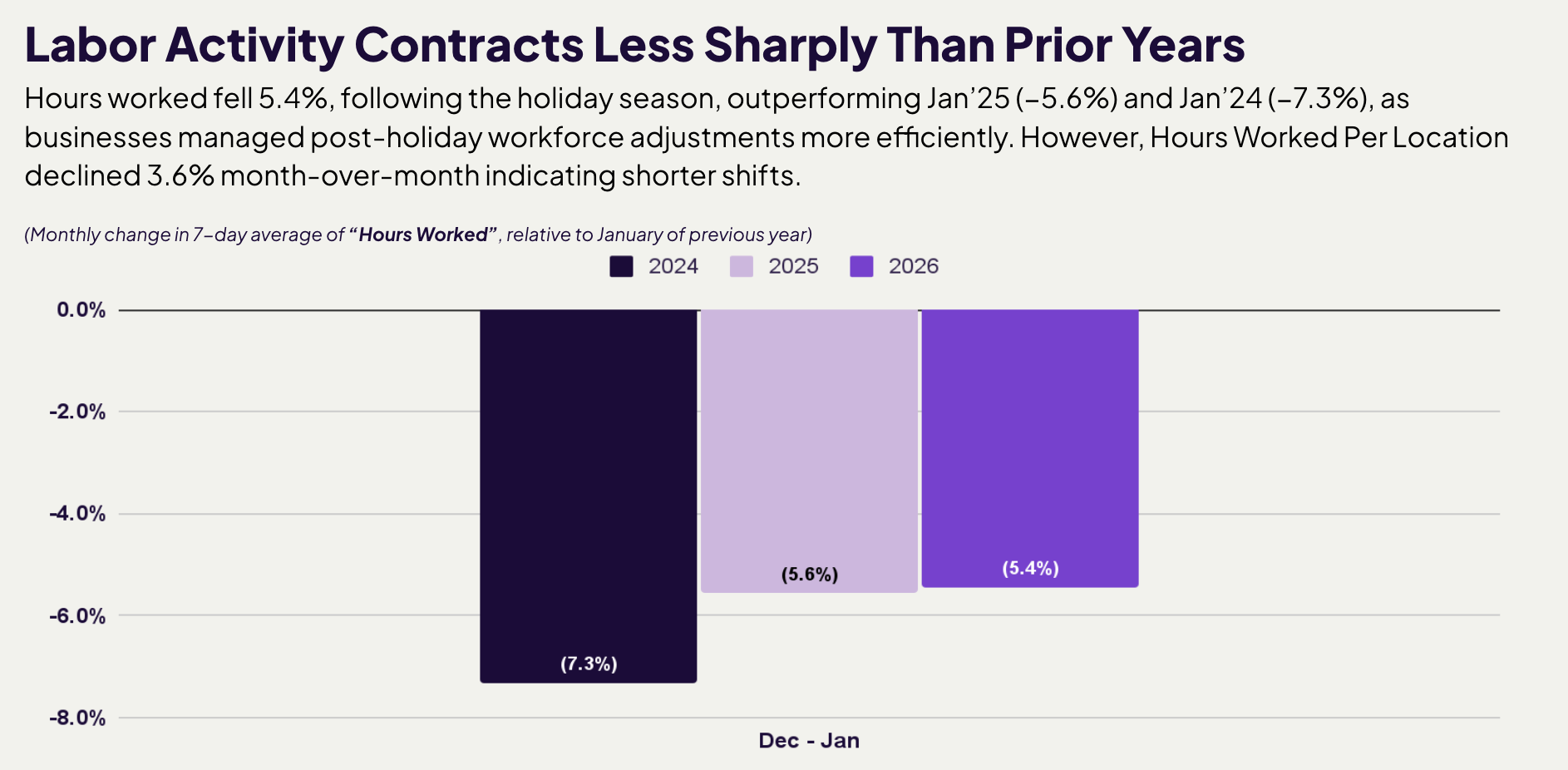

- Workforce participation and Hours Worked showed post-holiday declines similar to last year, suggesting labor market stability entering 2026.

- Late-January winter storms cost 13 states decline of 8% in Hours Worked during the affected week.

- Workforce participation neared stabilization in Healthcare (−0.9%) while Hospitality and Retail showed sector-specific recovery.

- Y/Y Hiring deficit narrowed to −2.4% from −7.1% (2025), while turnover stabilized at −0.4%, signaling labor market recovery momentum.

September 2025 REPORT

Main Street Holds Steady as Seasonal Contraction Continues

Key findings:

- Employee participation fell -3.6% and hours worked -4.7%, reflecting the typical late-summer pullback.

- Entertainment (-21.4%) and Hospitality (-10.7%) drove industry losses; Medical/Veterinary ticked up slightly.

- Wages rose across all sectors, now nearly 40% higher than early 2022.

- Hiring eased after August’s surge, while turnover stayed elevated compared to 2024 levels.