February 2026 REPORT

Main Street Labor Market Stabilizes, but Growth Remains Muted

Key findings:

- Workforce participation held nearly flat and hours worked edged up, improving from last year's February pullback but trailing 2024’s stronger seasonal lift — signaling stabilization, not expansion.

- Businesses open declined across all regions, led by the West; the Midwest posted gains in participation, while Hospitality outperformed and Home & Repair and Medical/Vet lagged.

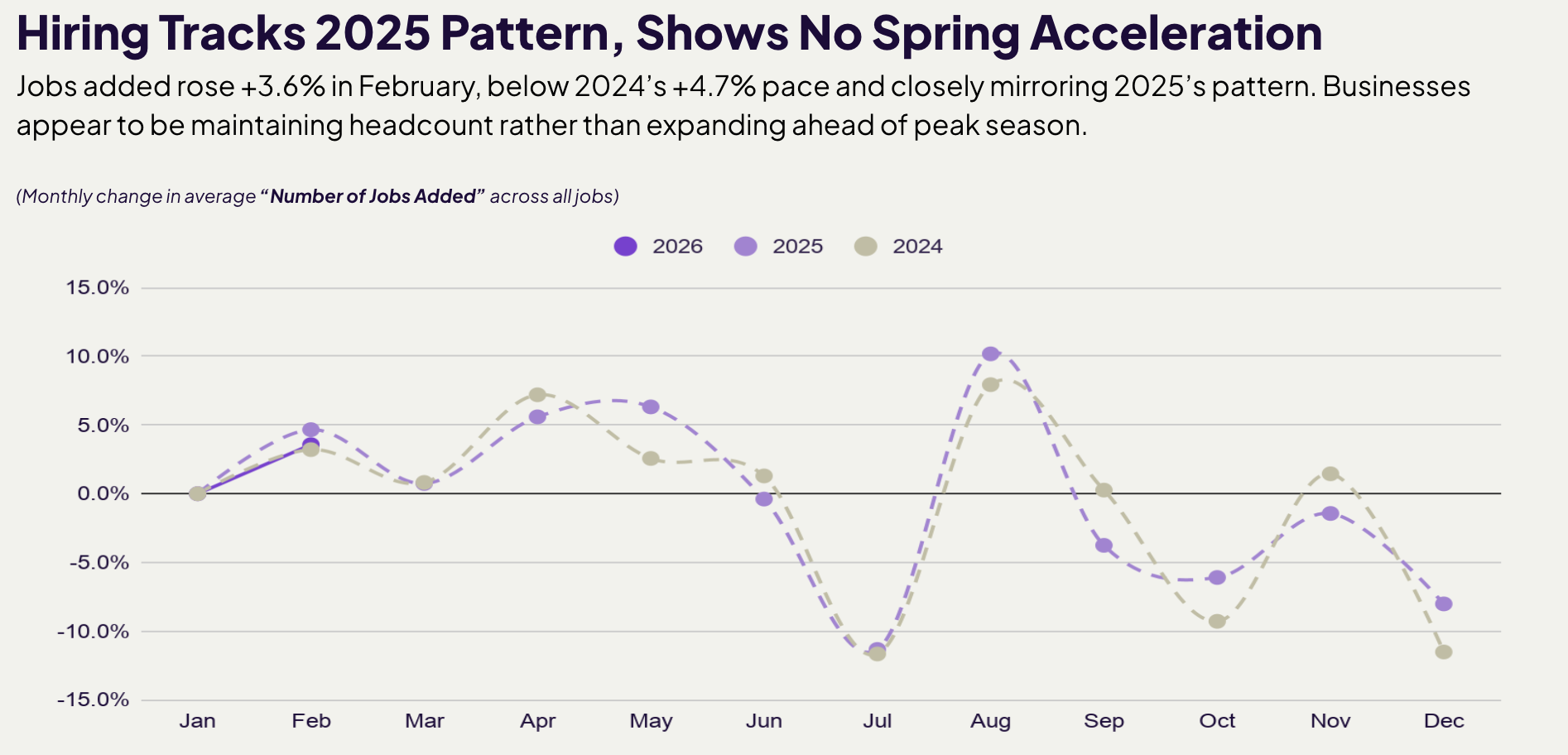

- Wages rose +1.3% m/m and hiring increased +3.6%, both below typical February pace; turnover fell to a three-year February low (-3.9%), pointing to post-holiday roster stabilization.

September 2025 REPORT

Main Street Holds Steady as Seasonal Contraction Continues

Key findings:

- Employee participation fell -3.6% and hours worked -4.7%, reflecting the typical late-summer pullback.

- Entertainment (-21.4%) and Hospitality (-10.7%) drove industry losses; Medical/Veterinary ticked up slightly.

- Wages rose across all sectors, now nearly 40% higher than early 2022.

- Hiring eased after August’s surge, while turnover stayed elevated compared to 2024 levels.