Your Saturday night just got hijacked by another scheduling meltdown. Three no-shows, two angry customers, and one team member who swears they "never got the message" about their shift. Meanwhile, Square is processing payments just fine, but it's doing absolutely nothing to prevent the chaos that's slowly killing your business—and your sanity.

Square works for payments, but it falls short on the team management tools that actually matter when you're running hourly teams. The processing fees sting, sure, but the real cost is those 2 AM panic texts and the Sunday nights you spend rebuilding schedules from scratch.

That's why smart managers are exploring square alternatives—some replace Square entirely, others integrate with your existing POS to fill the gaps Square leaves behind. Here are the best options that actually understand what it takes to manage hourly teams without losing your mind.

{{banner-cta}}

Why small businesses managing hourly teams are switching from Square

Square handles payments beautifully. What it doesn't handle is the 47 texts you'll get this week about schedule changes, the buddy punching that's inflating your labor costs, or the fact that you're juggling multiple apps to actually run your team.

The real cost isn't the processing fees—it's your time.

Most square alternatives focus on lower transaction rates or better POS features. But smart managers realize the bigger problem: Square treats team management like an afterthought. You get basic scheduling, basic time tracking, and zero help with the daily chaos of managing hourly workers.

Here's what's actually costing you money:

- Sunday night schedule rebuilds. Square's scheduling tools are fine for simple shifts, but try managing availability conflicts, time-off requests, and last-minute changes across 15 employees. You'll be there past midnight.

- Communication chaos. When your team uses personal phones for work messages, important information gets buried between TikToks and family group chats. Critical shift updates become "I never saw that text" excuses.

- Time theft you can't prove. Square's basic time clock can't prevent buddy punching or early clock-ins. You suspect it's happening, but you can't prove it without GPS verification or photo confirmation.

- Labor cost guesswork. You're scheduling based on gut feelings instead of sales data because Square doesn't integrate meaningfully with team management. Over-staff and kill profits. Under-staff and kill customer experience.

The businesses making the switch aren't just saving on processing fees—they're buying back their nights and weekends. They're choosing square alternatives that understand the difference between processing a payment and actually running a team.

Best Square alternatives for businesses with hourly teams

When you're managing hourly workers, you need more than payment processing—you need tools that prevent the operational chaos that kills your weekends. Here are the alternatives that actually get it:

Homebase: Best all-in-one team management solution

While Square offers basic team tools, Homebase is built specifically for the challenges of managing hourly teams. Auto-scheduling eliminates those Sunday night rebuild sessions. GPS-enabled time tracking stops buddy punching cold. Built-in messaging keeps work conversations separate from personal phones.

The game-changer? Homebase integrates with your existing POS system, so you get labor-to-sales ratios that help you staff smarter, not just cheaper. Free plan covers scheduling, time tracking, and team communication. Paid plans start at $24.95 per location.

Toast: Best for restaurants

Restaurant-specific features like tip pooling and QR code ordering. Built-in team management handles scheduling and payroll, but it's designed around restaurant workflows. Processing fees around 2.69%. Plans start at $69/month, but payroll is an expensive add-on at $110/month plus $4 per employee.

Clover: Best for payment flexibility

Solid team management features with scheduling and time tracking. The advantage? You can use your own merchant account instead of being locked into Square's processing rates. In-person rates as low as 2.3% + $0.10. Custom pricing based on your needs.

Shopify: Best for retail with e-commerce

Strong for businesses selling online and in-person. Basic team management through POS Pro ($89/month extra), but it's not built for complex hourly scheduling. Processing fees: 2.4-2.9% + $0.30 online, 2.4-2.7% in-person.

PayPal Zettle: Best for international businesses

Lower processing fees than Square (2.29% + $0.09 in-person), but minimal team management features. Good if you only need payment processing and handle scheduling elsewhere.

The reality check: Most Square alternatives focus on payments and treat team management as an afterthought. If you're spending more time managing your team than growing your business, choose a solution built for hourly workers from day one.

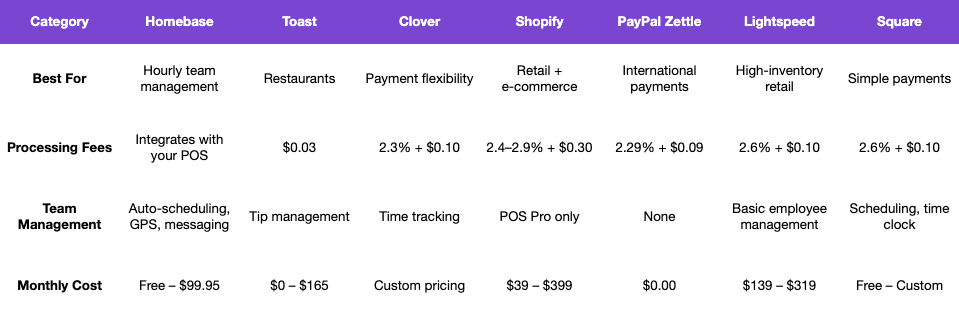

Quick Square alternatives comparison

The bottom line: If you're just processing payments, most alternatives offer similar rates. If you're managing hourly teams, only a few actually solve the scheduling chaos that's eating your weekends.

- Need team management? Choose Homebase or Toast.

- Want payment flexibility? Go with Clover.

- Selling online too? Consider Shopify.

- Just need cheaper processing? Try PayPal Zettle.

Square vs. top competitors: Team management comparison

The real question isn't whether other alternatives have lower processing fees—it's whether they solve the problems that made you search for square alternatives in the first place. Here's how the top contenders actually stack up when it comes to managing hourly teams, not just processing payments.

Square vs. Homebase: Payments vs. complete team management

Square gives you payment processing with basic scheduling tacked on. Homebase gives you comprehensive team management that integrates with your existing POS.

The difference? Square's scheduling can't handle availability conflicts or auto-generate schedules based on sales forecasts. You'll still spend Sunday nights rebuilding schedules manually. Homebase's auto-scheduling creates conflict-free schedules in minutes, and GPS time tracking prevents the buddy punching that Square can't stop.

Winner for hourly teams: Homebase. Square handles transactions; Homebase prevents operational chaos.

Square vs. Toast: General vs. restaurant-focused

Both offer team management, but Toast is built specifically for restaurant workflows. Toast handles tip pooling, kitchen display systems, and table management that Square doesn't touch.

The catch? Toast locks you into their payment processing with higher online rates (3.09% vs. Square's 2.6%), and payroll costs an extra $110/month. Square's restaurant plan is more affordable but lacks industry-specific features.

Winner for restaurants: Toast if you need specialized features; Square if you're budget-conscious.

Square vs. Clover: Locked-in vs. flexible payments

Square forces you to use their payment processing. Clover lets you choose your own merchant account, potentially saving money on processing fees (as low as 2.3% vs. Square's 2.6%).

For team management, both offer similar basic scheduling and time tracking. Neither matches Homebase's auto-scheduling or advanced team communication features.

Winner for payment flexibility: Clover. Winner for team management: Neither—you'll need a dedicated solution.

Most square alternatives improve on payment processing or add industry-specific features. Only Homebase focuses on solving the team management problems that actually keep you up at night.

How to switch from Square: A migration guide

Before you switch: Export your data

Download your Square reports (sales, customer data, inventory) from your Square Dashboard. Most alternatives can import this data, but you'll need it in CSV format. Do this first—some competitors make the export process easier than others.

Timeline: Plan for 2-3 weeks

Don't switch mid-payroll cycle. Plan your migration for the beginning of a pay period to avoid timesheet confusion. If you're adding team management tools (like Homebase), factor in an extra week for employee training.

Step-by-step switching process:

Week 1: Setup and testing

- Sign up for your new system and import your data

- Set up team management features (scheduling, time tracking, messaging)

- Test payment processing with small transactions

- Train one manager on the new system

Week 2: Team rollout

- Add employees to the new platform

- Run both systems parallel for safety

- Import historical schedules and availability

- Test team communication features

Week 3: Full migration

- Switch payment processing completely

- Deactivate Square account (after final reconciliation)

- Train remaining staff on new time clock/scheduling

Pro tip for team management switchers: If you're moving to Homebase, your team can start using scheduling and messaging features immediately while you keep Square for payments. This lets you solve the operational chaos without disrupting cash flow.

Common migration mistakes to avoid

- Switching during busy season or holiday periods

- Not backing up historical data first

- Forgetting to notify your payment processor about the change

- Rushing team training (confused employees = operational disasters)

The reality: Switching payment processors feels scary, but most managers wish they'd done it sooner. The Sunday night scheduling stress ends immediately.

{{banner-cta}}

Why Homebase is the best Square alternative for hourly teams

Most square alternatives treat team management like a nice-to-have feature. Homebase treats it like the core problem it actually is.

While Square gives you basic scheduling, Homebase gives you auto-scheduling that builds conflict-free schedules in minutes. While Square offers a simple time clock, Homebase prevents buddy punching with GPS verification and photo confirmation. While Square leaves you juggling personal phones for team communication, Homebase keeps work messages in one dedicated team communication app.

The bottom line: Square handles payments. Homebase handles the chaos that payments can't fix. Ready to reclaim your weekends? Start with Homebase's free plan—scheduling, time tracking, and team messaging included. No credit card required, no setup fees, no more Sunday night schedule panic. Get started for free with Homebase.

Share post on

Homebase Team

Remember: This is not legal advice. If you have questions about your particular situation, please consult a lawyer, CPA, or other appropriate professional advisor or agency.

Popular Topics

Homebase is the everything app for hourly teams, with employee scheduling, time clocks, payroll, team communication, and HR. 100,000+ small (but mighty) businesses rely on Homebase to make work radically easy and superpower their teams.