Economic indicators and recent interest rate hikes have sent mixed messages about short-term expectations around inflation and the likelihood of a recession.

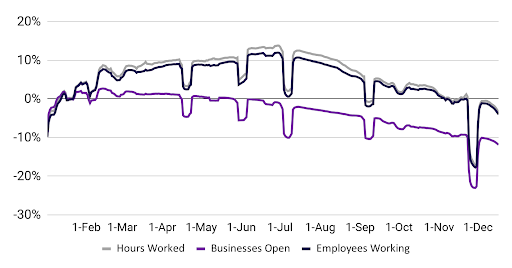

Continued slow downs in hours worked and employees working at small businesses have diverged from prior years, likely a result of decline in holiday spending.

In the past quarter, interest rate hikes and economic indicators on inflation and employment have led to widespread speculation that a recession is to be expected in 2023. To understand how the broader economic environment has impacted small businesses and their employees during the 2022 holiday season, we analyzed behavioral data from more than two million employees working at more than one hundred thousand SMBs.

Summary of findings: Homebase high-frequency timesheet data indicate continued slowdown in hours worked and employees working across most industries and major metro areas.

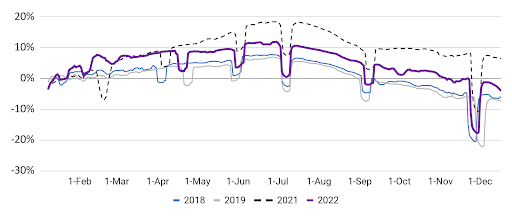

- Our key Main Street Health Metrics — hours worked and employees working — have continued prior month-over-month declines in December. Working employee count was down 3.5 percentage points over a 7-day rolling average in December relative to November. The December decline has been steeper than we have seen at the same time period in past years.

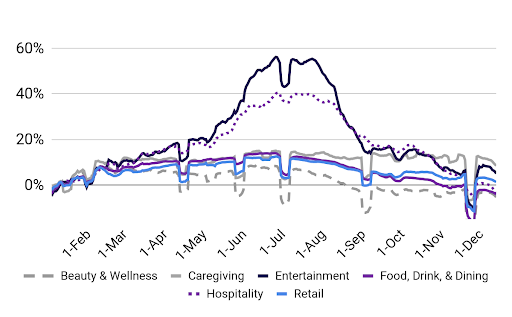

- Most industry categories exhibited declines in employees working in mid-December vs. mid-November, more so than in the past. Declines were starker than at the corresponding time period in 2019, with hospitality (-7.0%) and caregiving (-4.3%) showing the largest declines. Entertainment, while softer than its comparative level in 2019, bucked the trend with a monthly increase (+0.3% versus November).

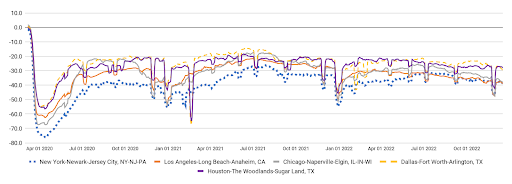

- Hours worked saw continued declines across the top 5 major metro areas. These declines have been a consistent trend in the past two quarters, though Chicago and Los Angeles have seen the most significant drops compared to one year ago.

The percentage of employees working continued to decline after the Thanksgiving holiday, down 3.5 percentage points from the previous month. This downward trend is slightly starker than we have seen at the same time period in previous years.

Employees working

(Rolling 7-day average; relative to Jan. of reported year)

Main Street Health Metrics1

(Rolling 7-day average; relative to Jan. 2022)

1. Some significant dips due to major U.S. holidays. Pronounced dip in mid-February 2021 coincides with the period including the Texas power crisis and severe weather in the Midwest. Dip in late September coincides with Hurricane Ian. Source: Homebase data.

Most industries, save for entertainment, have seen a pronounced decline in employees working during the week leading up to the 2022 holidays. Beauty & wellness and caregiving are farthest below their corresponding 2019 levels, in a shift from our November data.

Percent change in employees working

(Compared to January 2022 baseline using 7-day rolling average)1

Percent change in employees working

(Mid-December vs. mid-November, using January 2022 and January 2019 baselines) 1

1. December 11-17 vs. November 13-19 (2022) and December 8-14 vs. November 10-16 (2019). Pronounced dips generally coincide with major US Holidays. Source: Homebase data

Hours worked across top 5 Metropolitan Statistical Areas (MSAs) have continued to decline after the Thanksgiving holiday compared to mid-November levels, consistent with prior month-over-month trends. As in prior months, Los Angeles and Chicago are seeing the most significant drops from 2021 levels.

Hours worked

(Rolling 7-day average; relative to Jan. 2020 (pre-Covid))

1. Some significant dips due to major U.S. holidays. Pronounced dip in mid-February 2021 coincides with the period including the Texas power crisis and severe weather in the Midwest. Source: Homebase data.

For a PDF of our December report, please visit this PDF; if you choose to use this data for research or reporting purposes, please cite Homebase.

Link to PDF of: Homebase December 2022 Main Street Health Report – EOY