Holiday pay shouldn't be a guessing game. Whether you're figuring out Christmas bonuses or just trying to understand if you even need to offer it, the rules can feel murky. Some employers offer it. Others don't. Some employees expect time-and-a-half. Others just want the day off.

Here's the reality: holiday pay isn't federally mandated, but it's one of the smartest ways to keep your team happy and reduce turnover during your busiest seasons. This guide breaks down what holiday pay actually is, who qualifies, how to calculate it, and how to build a policy that works for your business.

TL;DR: Holiday pay

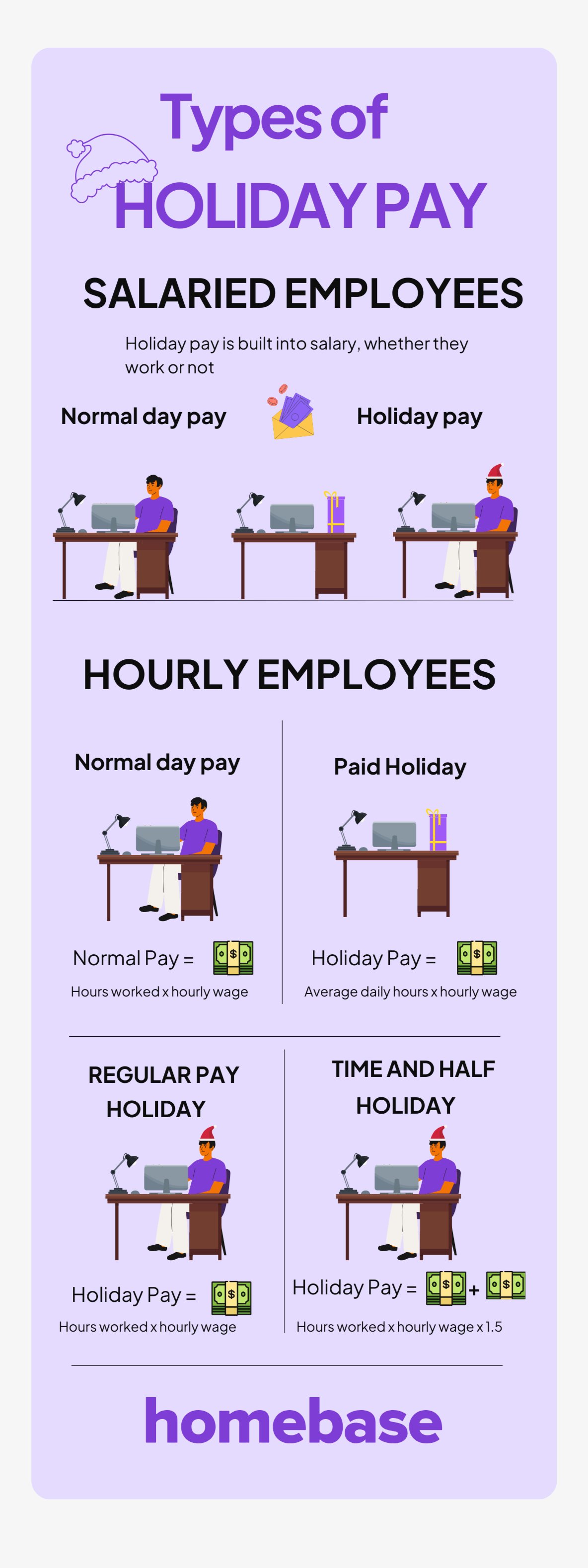

Holiday pay isn't required by federal law, but it's one of the smartest ways to keep your team happy and reduce turnover. There are two types: paid time off (employees get regular pay for holidays they don't work) and premium pay (employees earn extra—usually time-and-a-half or double time—for working holidays).

Common rates employers choose:

- Regular pay: Normal hourly rate × hours

- Time-and-a-half: Hourly rate × 1.5

- Double time: Hourly rate × 2

Example: An employee earning $16/hour working 8 hours on Thanksgiving at time-and-a-half would make $192 ($24/hour × 8 hours).

Who qualifies? That's entirely up to you and your company policy. Most businesses offer holiday pay to full-time employees, but eligibility is discretionary. Rhode Island has specific Sunday/holiday premium pay rules (generally 1.5×), and overtime interaction can differ for retail employers.

Bottom line: You decide which holidays to recognize (Thanksgiving, Christmas, New Year's, etc.), who's eligible, and what rate to pay. Build a clear policy, communicate it early, and apply it consistently.

What is holiday pay?

Holiday pay is compensation you provide to employees for recognized holidays—either as paid time off or as premium pay for working on the holiday itself. Under federal law (the Fair Labor Standards Act), private employers are not required to offer holiday pay, paid time off, or premium rates for holiday work. It's entirely a matter of your company policy, employment contract, or collective bargaining agreement.

There are two main types:

Paid time off for holidays: Your employee gets their regular pay for a holiday they don't work. If someone earns $15/hour and would normally work an 8-hour shift, they get $120 for the day off.

Premium pay for working holidays: Your employee works the holiday and earns extra—typically time-and-a-half (1.5x their regular rate) or double time (2x). If that same $15/hour employee works Christmas, they might earn $22.50/hour instead.

Common holidays that trigger holiday pay policies include New Year's Day, Memorial Day, Independence Day, Labor Day, Thanksgiving, and Christmas Day. Some employers also include Martin Luther King Jr. Day, Presidents' Day, Veterans Day, or Juneteenth.

What does time and a half mean?

Time-and-a-half is a premium pay rate where employees earn 1.5 times their regular hourly wage. It's one of the most common holiday pay rates offered by employers.

Here's how it works: If an employee's regular rate is $20/hour, their time-and-a-half rate would be $30/hour ($20 × 1.5). For an 8-hour shift on a holiday, they'd earn $240 instead of their regular $160.

Some employers offer even higher rates, like double time (2x the regular rate), for major holidays like Christmas or New Year's Day. But time-and-a-half is the standard premium in most industries.

Important note: Time-and-a-half for holiday work is separate from overtime. Under federal law (FLSA), overtime kicks in when an employee works more than 40 hours in a week—not simply because they worked a holiday. If working a holiday pushes someone over 40 hours, they'd be entitled to overtime pay, but the two aren't automatically connected.

How does holiday pay work?

Holiday pay works differently depending on whether your employee has the day off or works the holiday.

When employees get the day off

Let's say Cheryl works at a hair salon and typically works Thursdays. Thanksgiving falls on a Thursday this year. The salon is closed, but Cheryl's boss offers paid holidays.

Cheryl earns $18/hour and would have worked an 8-hour shift. She gets paid $144 for Thanksgiving even though she didn't work. That's 8 hours × $18/hour = $144.

When employees work the holiday

Now let's say the salon stays open on Black Friday, and Cheryl volunteers to work. Her boss offers time-and-a-half for holiday work.

Cheryl works her usual 8-hour shift. Instead of $18/hour, she earns $27/hour (1.5 × $18). For that single day, she makes $216 instead of $144.

Some businesses offer double time (2x pay) for major holidays like Christmas. In that case, Cheryl would earn $36/hour, or $288 for the day.

Who qualifies for holiday pay?

Because holiday pay isn't mandated by federal law, eligibility is entirely determined by your company policy or employment contract.

Full-time employees often receive holiday pay if a business chooses to offer it. Many companies define full-time as 30+ hours per week.

Part-time employees may or may not qualify, depending on your policy. Some businesses offer prorated holiday pay based on average hours worked. Others limit holiday pay to full-timers only.

Salaried employees typically receive their regular salary regardless of holidays. If they're exempt under FLSA, they get paid the same whether they work the holiday or not.

Hourly employees are where holiday pay policies really come into play. If you offer it, they either get paid for the day off or earn premium pay for working.

Independent contractors typically don't receive holiday pay because they're not employees. Benefits like paid holidays don't apply unless specifically negotiated in the contract.

Eligibility requirements to consider

Many businesses add requirements to ensure fairness:

- Minimum tenure: Employees must work for you for 30, 60, or 90 days before qualifying

- Hours threshold: Part-timers must average 20+ hours per week to qualify

- No-call/no-show rule: If someone doesn't show up for their scheduled shift before or after the holiday without notice, they forfeit holiday pay

Whatever rules you set, apply them fairly across your entire team.

How much is holiday pay?

Regular pay (1x): Your employee gets their normal hourly rate for the holiday, even if they don't work.

Time-and-a-half (1.5x): Your employee earns 1.5 times their regular rate for working the holiday. This is the most common premium structure.

Double time (2x): Your employee earns twice their regular rate for working the holiday. Some employers offer this for major holidays like Christmas.

Tracking different wage rates manually gets messy fast. We handle multiple pay rates automatically, so you're not doing math on napkins when someone switches roles mid-week.

How to calculate holiday pay: Step-by-step examples

Calculating holiday pay depends on your policy and whether employees work the holiday. Here are three common scenarios:

Scenario 1: Employee doesn't work, gets paid holiday

Formula: Average daily hours × hourly wage = Holiday pay

Example: An employee usually works 8 hours per day and earns $15/hour. On Thanksgiving (which they have off), their holiday pay would be:

8 hours × $15/hour = $120

They receive $120 even though they didn't work.

Scenario 2: Employee works on the holiday, gets premium pay (time-and-a-half)

There are two ways to calculate this—both give the same result:

Method 1: (Hours worked × hourly wage) + [(hours worked × hourly wage) × 0.5]

Example: Employee works 6 hours at $15/hour with time-and-a-half:

(6 × $15) + [(6 × $15) × 0.5] = $90 + $45 = $135

The employee earns their regular $90, plus an extra $45 (50% premium).

Method 2: Hours worked × hourly wage × 1.5

Example: Same scenario using the simpler formula:

6 hours × $15/hour × 1.5 = $135

This method is faster and gives the same result.

Scenario 3: Employee works on the holiday, gets double-time pay

Formula: Hours worked × hourly wage × 2

Example: Employee works 6 hours on Christmas at $15/hour with double time:

6 hours × $15/hour × 2 = $180

The employee earns twice their normal rate for every hour worked.

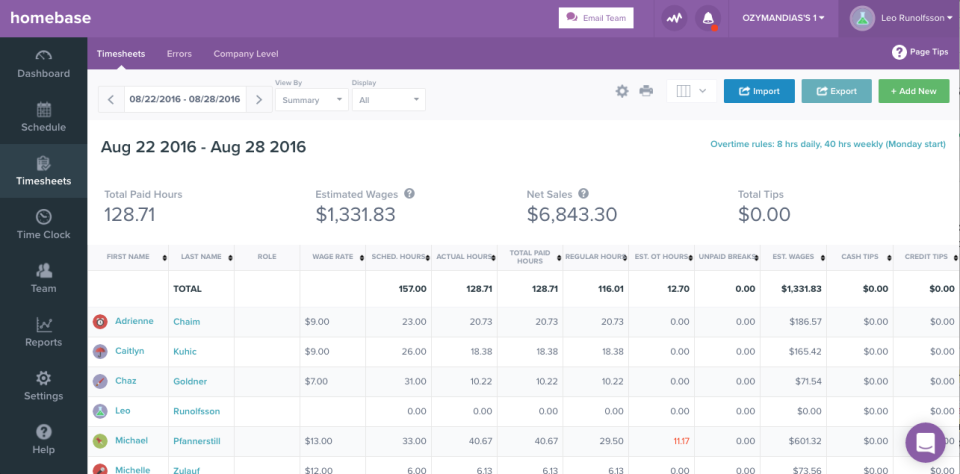

Pro tip: Homebase payroll lets you set up "holiday season" periods with custom wage rules. The platform automatically calculates different rates and overtime for employees working during those periods—no manual math required.

Is holiday pay mandatory?

No. Holiday pay is not required by federal law.

The Fair Labor Standards Act (FLSA) doesn't mandate that employers provide paid holidays, holiday premiums, or any special compensation for working holidays. If you're a private employer, you can choose not to offer holiday pay at all.

That said, a few states have specific requirements, though they're limited in scope.

States with holiday pay requirements

Most states, including Texas, Florida, New York, Illinois, California, and Washington, have no laws requiring private employers to provide holiday pay. It's entirely at your discretion.

Rhode Island: In Rhode Island, for retail employees, Sunday/holiday premium hours can be excluded from the overtime calculation in the same week. This applies to specific holidays including New Year's Day, Independence Day, Veterans Day, Thanksgiving, and Christmas. Requirements vary by business type (retail vs. non-retail) with exemptions for continuous operations.

Massachusetts: As of January 1, 2023, Massachusetts eliminated its Blue Laws premium pay requirement for retail workers. Private employers are no longer required to pay premium rates for holiday work unless specified in an employment contract or collective bargaining agreement.

California: No statewide law requires private employers to provide holiday pay. Some collective bargaining agreements or prevailing wage laws for specific industries may include holiday pay requirements.

Federal contractors: If you hold certain federal service or construction contracts governed by the Davis-Bacon Act or McNamara-O'Hara Service Contract Act, you may be required to provide holiday pay only if it's specified in the wage determination for your contract. This isn't a blanket requirement for all federal contractors—check your specific contract terms.

Note: State labor laws can change. Always verify current requirements with your state's department of labor, especially if you operate in multiple locations.

What about overtime on holidays?

Holiday pay and overtime are separate under federal law. If an employee works more than 40 hours in a workweek, they're entitled to overtime (1.5x their regular rate) under FLSA. But working a holiday doesn't automatically trigger overtime unless it pushes them over the 40-hour threshold.

Example: Jenna works 40 hours Monday–Friday, then volunteers to work 8 hours on Saturday (a holiday). She's now at 48 hours for the week, so she qualifies for overtime pay at 1.5x her regular rate. If your company policy also offers holiday premium pay (say, 1.5x), you generally pay whichever rate is required—in this case, the overtime rate.

However, some state laws may require both holiday premium and overtime to apply, resulting in higher total pay. Always check your state's specific rules.

You're not a labor lawyer. You shouldn't have to research state regulations at midnight. We automatically apply federal, state, and city-specific wage rules so you stay compliant without becoming a legal expert.

{{banner-cta}}

Why offer holiday pay?

You're not required to offer holiday pay, but there are real business reasons why it makes sense:

Reduce turnover and increase retention

When employees feel valued during the holidays, they're more likely to stick around. Holiday pay shows you recognize their sacrifice when they work (or their need for rest when they don't). Lower turnover means less money spent on recruiting, hiring, and training replacements. According to industry data, replacing an hourly employee costs 16-20% of their annual salary.

Boost motivation and productivity

Premium pay for working holidays incentivizes employees to volunteer for shifts during your busiest times. Instead of scrambling to cover Thanksgiving or Christmas Eve, you'll have willing team members who see the extra compensation as worth it. This willingness translates to better service and higher productivity during critical periods. Employees who take time off during paid holidays also return to work refreshed and more focused.

Support diversity and inclusion

Acknowledging holidays beyond the standard federal list—like Diwali, Hanukkah, Eid, or Juneteenth—shows respect for your team's diverse backgrounds. Offering floating holidays or letting employees choose which holidays matter most to them builds a more inclusive workplace culture. This can be especially important for attracting and retaining employees from different cultural and religious backgrounds.

How to create a holiday pay policy

Building a holiday pay policy doesn't have to be complicated. Here's what to include:

- Which holidays you'll recognize: Pick 6-10 holidays that align with your business needs (New Year's Day, Memorial Day, Independence Day, Labor Day, Thanksgiving, Christmas). Consider adding holidays that reflect your team's diversity.

- Your pay structure: Decide whether you'll offer paid time off, premium pay for working holidays (time-and-a-half or double time), or both. Be realistic about your budget—offering premium pay on six holidays can add up fast if you have a large team.

- Eligibility requirements: Define who qualifies—full-time only or part-timers too? Do employees need 30-90 days of tenure first? Do part-timers need to average a certain number of hours per week?

- Rules for working holidays: Do employees need to work their scheduled shift before and after the holiday to qualify? This prevents people from extending their holiday weekend by calling out. What happens if someone no-shows without notice?

- What happens if the holiday falls on a day off: If Christmas falls on a Sunday and an employee doesn't normally work Sundays, do they get a paid day off anyway? Will you move the holiday to Monday or Friday? Some businesses offer a floating holiday in this situation—an extra paid day off the employee can use later.

- Unused holiday pay: Clarify what happens if an employee quits or gets terminated—do they get paid out for unused holidays? In most states, you're not required to, but it's worth clarifying in your policy.

- Put it in writing: Your policy should live in your employee handbook and be accessible to your entire team. Include which holidays are recognized, whether employees get paid time off or premium pay, eligibility requirements, how pay is calculated, and what happens if a holiday falls on a day off or during PTO.

- Communicate it early: Don't spring your holiday policy on your team in December. Share it at the start of Q4 (or even earlier) so employees can plan accordingly.

Setting the rules is one thing. Remembering to apply them consistently is another. We let you set wage rules by role, track who worked which holidays, and sync everything with payroll automatically so you're not scrambling to do the math every pay period.

Holiday pay FAQs

What is holiday pay and how does it work?

Holiday pay is compensation for recognized holidays, either as paid time off or premium pay for working the holiday. It's not required by federal law—it's determined by your company policy or employment contract. You decide which holidays to recognize and whether employees get regular pay, time-and-a-half, or double time.

What does time and a half mean?

Time-and-a-half means employees earn 1.5 times their regular hourly rate. For example, if someone normally earns $20/hour, they'd earn $30/hour (1.5 × $20) for hours worked on a holiday. It's the most common premium pay rate employers offer for holiday work.

How much is holiday pay for $16 an hour?

If you offer paid time off, an 8-hour shift at $16/hour = $128. If you offer time-and-a-half for working the holiday, $16 × 1.5 = $24/hour, or $192 for 8 hours. If you offer double time, $16 × 2 = $32/hour, or $256 for 8 hours. The rate you choose is up to you.

How do you calculate holiday pay?

Calculate holiday pay by multiplying the employee's regular hourly rate by any applicable premium. For time-and-a-half: (hourly rate × 1.5) × hours worked. For double time: (hourly rate × 2) × hours worked. For paid holidays not worked: average daily hours × hourly rate. See our step-by-step examples above for detailed calculations.

What is the difference between holiday pay and PTO?

Holiday pay specifically compensates employees for recognized holidays (like Christmas or Thanksgiving), either as paid time off or premium pay for working. PTO (paid time off) is broader—it's flexible leave employees can use for vacation, sick days, or personal reasons. Holiday pay often comes with premium rates (time-and-a-half), while PTO is typically paid at regular rates.

Does California require holiday pay?

No. California has no statewide law requiring private employers to provide holiday pay. However, some collective bargaining agreements or prevailing wage laws for specific industries may include holiday pay requirements. Private employers are not mandated to offer it.

Does holiday pay count toward overtime?

Under federal law (FLSA), holiday pay for a day an employee doesn't work doesn't count toward the 40-hour threshold for overtime. However, if an employee works on a holiday and that work pushes them over 40 hours for the week, they're entitled to overtime pay at 1.5x their regular rate. In most cases, you pay whichever rate is higher—not both stacked.

Use Homebase to manage holiday pay without the headache

You've built your policy. Now make it work without the manual tracking, surprise payroll costs, or midnight math sessions.

Here's what gets messy without the right tools: remembering who worked which holiday and at what rate, calculating time-and-a-half or double time for employees with different hourly rates, tracking holiday pay separately from regular hours and overtime, and making sure your payroll system applies the right rules every time.

We handle all of it automatically. Set your holiday pay rules once—by role, by location, or by employee type—and we'll track who worked, calculate the right rates, and sync everything with payroll. No spreadsheets. No dividing by 60. No crossed fingers hoping you got it right.

You shouldn't have to choose between offering great benefits and actually having time to run your business. Try Homebase free and see how easy holiday pay can be.

Share post on

Homebase Team

Remember: This is not legal advice. If you have questions about your particular situation, please consult a lawyer, CPA, or other appropriate professional advisor or agency.

Popular Topics

Homebase is the everything app for hourly teams, with employee scheduling, time clocks, payroll, team communication, and HR. 100,000+ small (but mighty) businesses rely on Homebase to make work radically easy and superpower their teams.