Hourly Salary Calculator – Calculate Gross Pay From Hourly Rate

Calculate your workers’ gross pay: weekly, bi-weekly, or monthly.

Add on:

How to use the free hourly pay calculator

1. Select your pay frequency

Choose how often you get paid from weekly, bi-weekly, twice a month, or once a monthly.

2. Add your wage and hours

Enter your hourly wage and the number of hours you worked in this pay period.

3. Add overtime if applicable

If you worked any overtime, add the number of hours and the rate at which you earn overtime.

This hourly pay calculator is provided for free and without warranty as to its capability or effectiveness for any particular purpose.

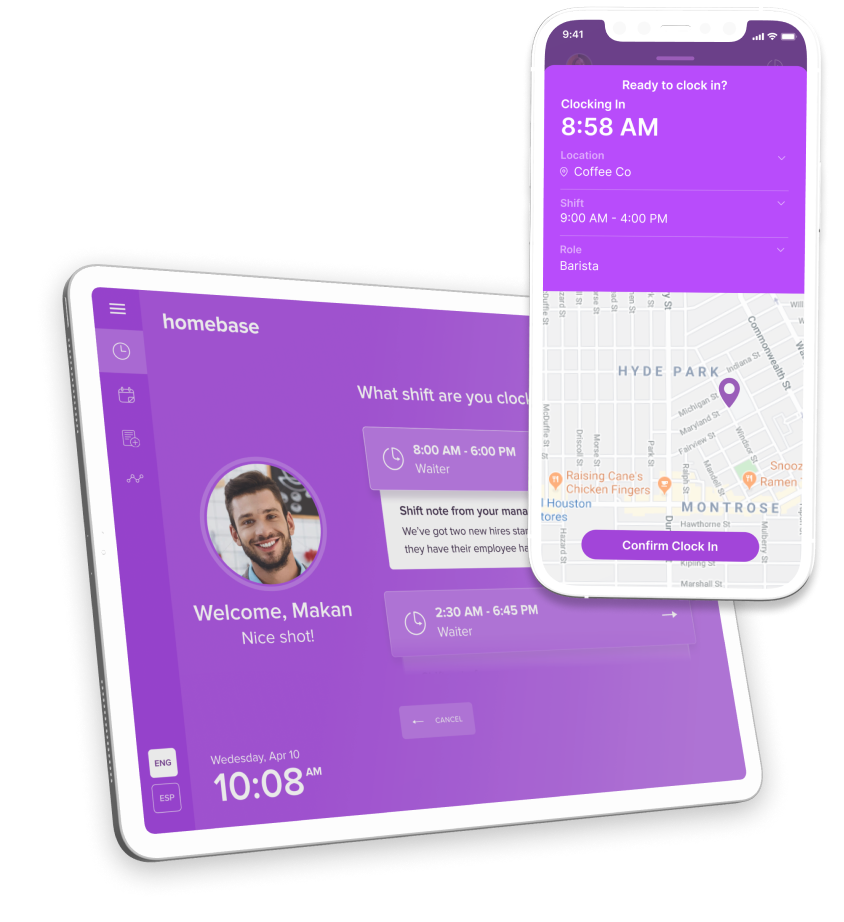

Loved by 100K+ small businesses.

Start saving time today.

- Track hours, breaks, and overtime accurately

- Get reminders for upcoming shifts and breaks

- Automatically turn hours into wages for easier payroll

Hourly to salary calculation

If you’ve got hourly workers, it can be complicated and time-consuming to calculate their pay accurately every week. Calculating hourly to salary or hourly to gross pay can be done for a variety of pay periods. The most common are:

- Weekly, where workers are paid once a week (52 pay periods/year)

- Bi-weekly, where workers are paid every other week (26 pay periods/year)

- Semi-monthly, where workers are paid twice a month (24 pay periods/year)

- Monthly, where workers are paid once a month (12 pay periods/year)

Determining which pay period—the time that passes between each payroll—works best for your business depends on your industry, the workers you’ve hired, and the state you live in.

Most business owners who employ hourly workers tend to pay weekly or biweekly. With more people working multiple jobs, or living paycheck to paycheck (more common for hourly workers), paying workers more frequently can go a long way.

Different states have different laws. In Arizona, for instance, you have to pay your employees a minimum of twice a month not more than 16 days apart. Most states also require that workers get paid at least once a month.

How to calculate gross pay

To do things right, you should use the type of pay calculator and follow the proper steps.

To begin with, you’ll want to make sure you’re balancing payroll frequency against your business income and cash flow needs. Then, you’ll need to ensure that your workers are getting paid the right amount and that everything matches up for your bottom line.

Without considering these accounting must-do’s first, you might run into some serious business problems—like not having the necessary funds when you need them, or confused employees checking their bank accounts on payday.

(P.S. Homebase has a easy to use tools to make that payroll simpler, more accurate, and compliant.

When you’re calculating the gross pay for your hourly employees, the math is (mostly) simple.

First, multiply your worker’s hourly rate by the hours they’ve worked in the specified pay period. Don’t forget to account for overtime hours and breaks. You can do that manually, or with an hourly pay calculator.

Sometimes the math is complex: like if one of your workers clocked in for their eight-hour shift, took two 15’s and a 30-minute break, then stayed three hours late because someone called in sick.

For a simple example: if an employee worked a single three-hour shift with zero breaks in their one-week pay period, the calculation would go as follows:

# of hours x $ (hourly pay) = gross pay

Unfortunately, typical shift work can be a bit more nuanced than that.

How does overtime hourly pay work?

Add overtime into your wage calculator, as well as make sure you’re abiding by the necessary federal overtime laws.

The federal government has their own overtime pay requirement. This means that your workers legally need to be paid additional wages if they work outside of their regular hours. The US Department of Labor states the overtime rate for non-exempt employees needs to be at least one and a half times their regular rate of pay if they work more than 40 hours in one workweek.

Confused about exempt vs. non-exempt? Non-exempt means if a worker earns less than $684 per week, or $35,568 per year, you’re required to pay those overtime hours.

In charge of paying your team? Make sure you’re up to date on all other federal wage law specifics.

When it comes to calculating gross pay, including overtime, the math goes like this:

- Multiply the number of overtime hours worked x the overtime pay rate

- Add the regular pay and the overtime pay together for that pay period

You now have your gross pay calculation, including overtime.

Remember: things like an hourly paycheck calculator can only do so much when it comes to paying your employees. If you’re looking for an hourly calculator to figure out things like gross pay or changing pay from hourly to salary, then you might have a few other HR needs.

We’re talking compliance, communication, and time tracking so you can pay your team accurately and on time.

Save yourself the time and stress and do it all with Homebase.

Hourly calculator FAQs

What is gross pay?

Gross pay is the total amount of money a worker earns before deductions or taxes are taken out. This includes their hourly rate, project or piece pay rates, tips and bonuses, sick pay, vacation pay, and any overtime pay they’ve earned.

If it’s a salaried worker, it would be the breakdown from their salary divided by the number of pay periods (e.g. a $50,000 yearly salary paid weekly means the weekly gross pay is $961.54).

How do I calculate my gross pay from hourly rate?

To calculate gross pay from an hourly rate, multiply your worker’s hourly rate by the hours they’ve worked in a set pay period. You’ll also have to include any overtime they’ve worked in your calculation.

What’s the overtime pay rate?

Federal law states that the overtime pay rate must be at least 1.5 times the amount of a worker’s hourly pay rate.

How do I know if I need to pay overtime?

An employee who earns less than $684 per week, or $35,568 per year, is required to receive overtime pay for any hours worked in excess of 40 hours per week. Other characteristics of employees who require overtime pay are:

- they’re directly supervised by a manager;

- they’re not employed in what’s referred to as a “bona-fide executive, administrative, outside salesman, or professional capacity”

- they don’t make their own management decisions and are expected to follow orders

How do I know if I’m exempt from federal taxes?

You’re tax-exempt when you don’t meet the requirements for paying tax. Typically, that’s when your income is lower than the tax threshold. There are also a few other considerations, like if you’re over 65 or if you’re blind.

And remember: claiming “exempt” from federal tax withholding on your W4 when you’re not actually eligible is illegal.

How do I calculate taxes from my hourly pay?

What are the perks of using online software instead of an hourly calculator?

There are a ton of perks when it comes to using online software instead of a more basic hourly calculator. Using an hourly paycheck calculator only does one small part of a much bigger job. Because calculating pay is one of the most important parts of managing a team (especially to them!), you’ll reduce errors, add efficiencies, and stay compliant with local labor laws when you use an integrated online software tool to pay your team.