Are there any holiday pay laws employers should know?

- There are no federal laws requiring holiday pay, but it’s a nice benefit to offer your employees.

- Many businesses offer overtime pay for hours worked on holidays, meaning an increase in labor costs.

- Homebase helps you keep your labor costs in check with forecasting, automatic alerts, and more.

What are the holiday pay laws?

Federal law, specifically the Fair Labor Standards Act (FLSA) does not require US employers to pay employees overtime pay for time worked on holidays. There are also no federal laws that say employers are required to pay for time not worked like vacations, annual leave, and federal holidays. Doing so is usually a policy willfully created by the employer as an agreement in the employee handbook.

It’s important to note that in most states, if you include a holiday pay policy in your employee handbook, you must adhere to the policy. Failing to do so could lead to an employment lawsuit.

Most states also do not require employers to pay extra either. In terms of holiday pay, California law does not require business owners to provide overtime pay on holidays, or pay for hours not worked. Take a look at your state labor law guide to learn more.

However, there are two states that require employers to do so. Massachusetts and Rhode Island are the only states with a law dictating holiday pay for hourly workers. The state of Massachusetts’ blue laws have different requirements for retail businesses and non-retail businesses, but generally employees are entitled to 1.5 times their regular rate of pay for working on certain holidays.

Rhode Island also requires employers to pay time-and-a-half to employees who work on Sundays and certain holidays. If the holiday falls on a Sunday, the following Monday is when it is observed.

Many small businesses, and even large companies, provide holiday pay despite not being required to. For example, Amazon employees eligible for holiday pay receive an Amazon holiday pay of 1.5 times their regular rate when working holidays.

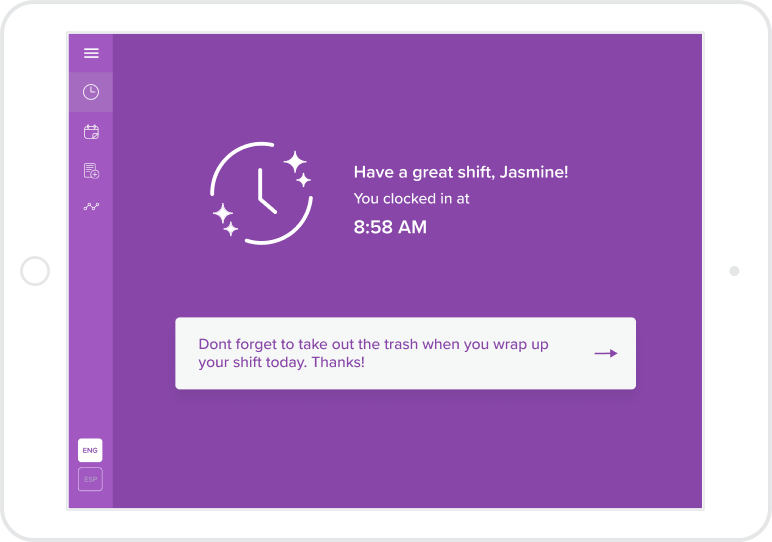

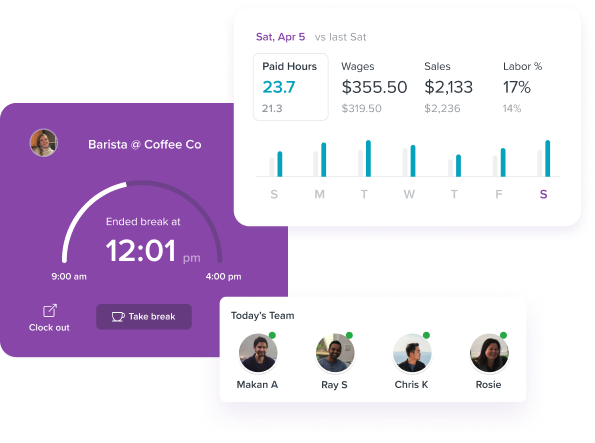

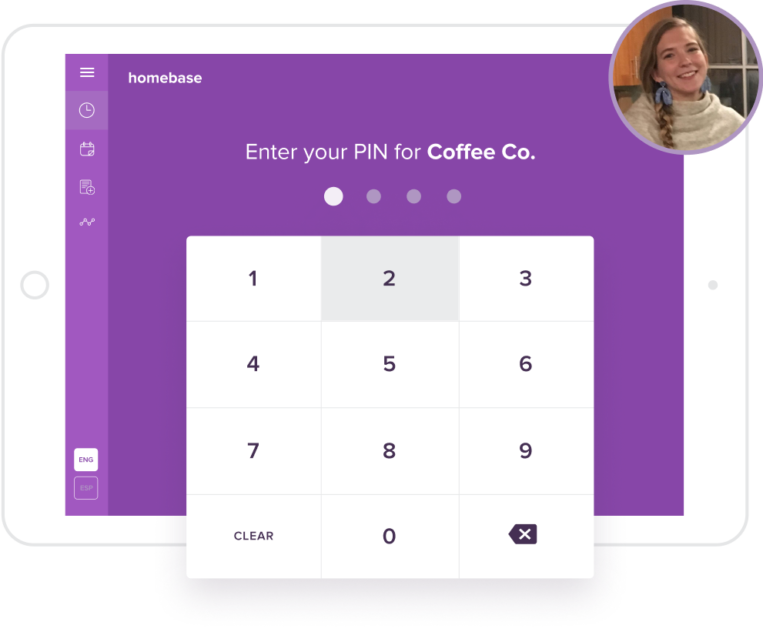

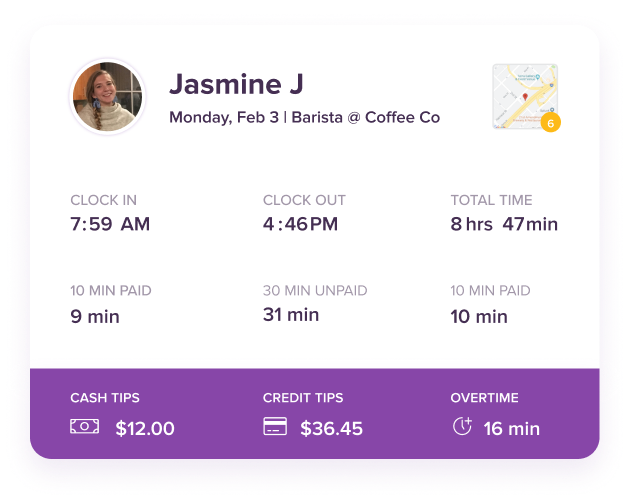

Whether you are required to provide holiday pay or simply want to provide it as a benefit to your team, Homebase can help you keep track of your labor costs so you can ensure you have enough funds to do so. With added visibility into your budget through advanced scheduling and alerts, you can forecast labor costs and overtime automatically when you are building your schedule.

How much is holiday pay?

Businesses that provide holiday pay to their employees typically provide the usual overtime amount. This means you would pay your employees 1.5 times their regular rate of pay.

In terms of how many holidays businesses typically provide, the Bureau of Labor Statistics reports that employees in the US receive 7.6 paid holidays on average.

If you have exempt employees who don’t receive an hourly wage or overtime as opposed to non-exempt or part-time employees, you would simply pay them their regular rate for the time not worked on the holiday.

You’ll likely want to save money on labor costs if you are offering the extra benefit, and Homebase can help. In your mobile app or on your desktop, Homebase will alert you when an employee is about to hit overtime or is expected to hit more than 40 hours in the week. You can even track overtime across multiple locations.

Barzotto

Marko Sotto

Owner at Barzotto

What is Equal Employment Opportunity?

The Civil Rights Act of 1964 prohibits you as an employer from discriminating against employees and treating them unfairly based on their race, color, gender, religion, or national origin.

Additionally, the Americans with Disabilities Act (ADA) prohibits you from denying reasonable accommodations to employees with either mental or physical disabilities. The Age Discrimination in Employment Act also prevents discrimination against employees and job applicants.

If employees feel they are being unfairly treated or discriminated against by an employer, they have the right to file a complaint. These complaints could lead to fines and potentially lawsuits.

As with the FLSA, HR Pro can help you better understand the ins and outs of these acts so you can make better decisions and learn what it takes to prevent a lawsuit. You can easily get started with HR Pro today to get the extra help you need to stay compliant.

What do I need to know about workplace standards?

Workplace safety is another employee right, meaning you must provide a healthy, safe, and positive environment for all workers. All employees that perform the same or similar job must have access to equal working quarters. You should not provide special accommodations for certain employees, unless those accommodations are due to a disability.

You need to also ensure your workplace is entirely free from hazards that could potentially harm a worker. The Occupational Safety and Health Administration (OSHA) has rules in place that require you to follow certain safety standards based on your industry. To learn more about OSHA and their workplace requirements, take a look at their website.

To better understand rules and regulations implemented by OSHA and other federal laws, let HR Pro give you a hand. Take advantage of the plethora of resources our certified experts provide in order to make compliance that much easier.